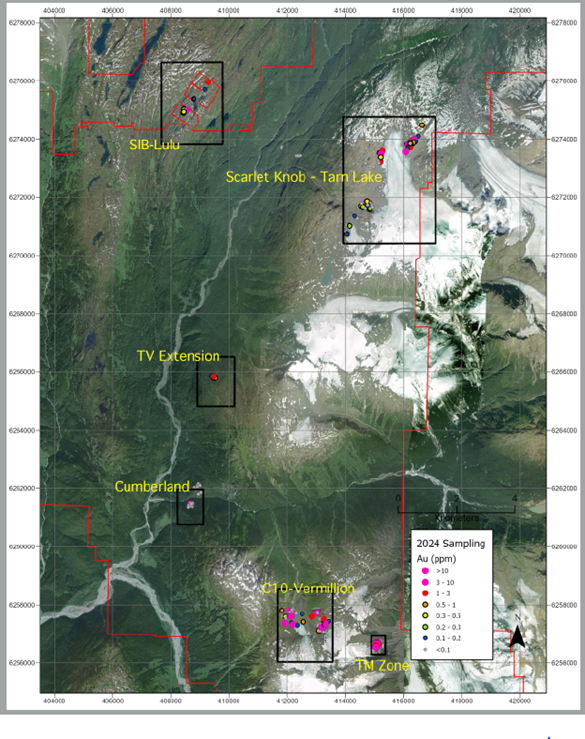

TORONTO, ON / ACCESSWIRE / October 8, 2024 / Eskay Mining Corp. ("Eskay" or the "Company") (TSXV:ESK)(OTCQX:ESKYF)(Frankfurt:KN7) (WKN: A0YDPM) is pleased to announce results from it 2024 prospecting campaign. Areas of focus included newly identified outcropping high-grade gold veins located in the southern portions of the Company's 100% controlled Consolidated Eskay property (the "Property"). Areas that were prospected are shown in Figure 1.

Mac Balkam, CEO & President of Eskay Mining, stated, "over the past 5 years Eskay has undertaken a property wide multi faceted exploration program identifying numerous VMS systems and building a wealth of geological data. Our 2024 prospecting program was commissioned to establish a short list for a significant 2025 discovery. The assay results from our prospecting surpassed expectations and in particular, the high grade outcrop gold/ silver assays along a 3km stretch of the C-10 -Vermillion-TM belt is a very promising drill area, among others, for 2025."

Southern Region

In 2020, Eskay conducted BLEG stream sediment sampling across many parts of the Property with promising gold anomalies coming from multiple watersheds, especially in the south (please refer to a Company news release dated Feb. 25, 2021 for more details). Early interpretation of this data postulated that these anomalous basins might host precious metal-rich volcanogenic massive sulfide ("VMS") deposits, especially when outcrops of VMS mineralization were discovered the subsequent year. Drill testing of these targets failed to yield significant precious metal values leaving this anomalism unexplained.

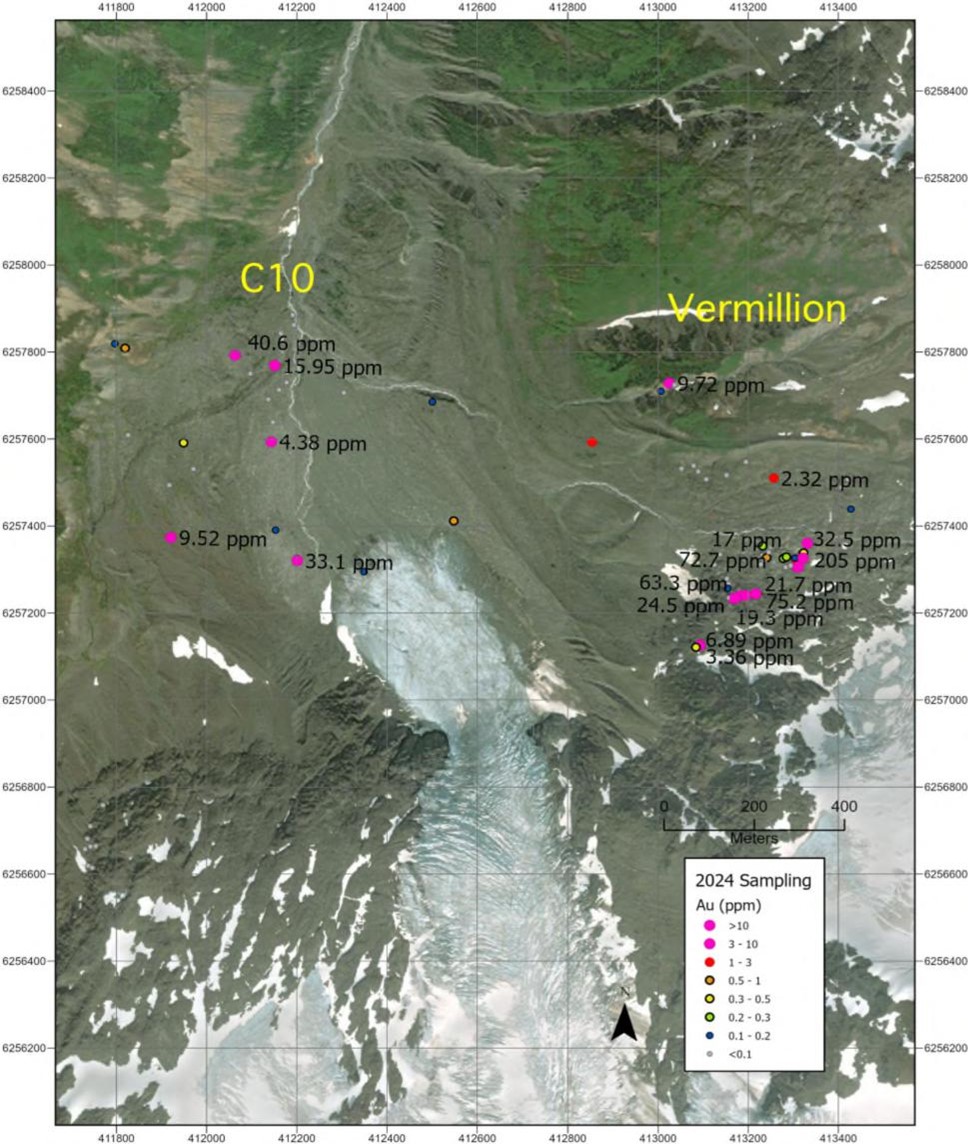

Prospecting and sampling in 2024 at C10-Vermillion as well as a new area near Ted Morris Glacier ("TM Zone") has resulted in the discovery of numerous high-grade quartz-carbonate-sulfide veins and stockwork veining in shear zones. These are now strongly viewed as the likely source of the prolific gold anomalies in BLEG samples in this area ( Figure 2 ). A close-up photo of high-grade quartz-carbonate-sulfide vein material is shown in Figure 3 . Because of the strong similarities in vein styles identified at C10, Vermillion and the TM Zone, Eskay takes the view that these areas are part of the same mineralizing event and that it is likely that more prospecting could lead to the discovery of more such veins.

Highlights from C10-Vermillion

-

One hundred two rock chip and float samples collected at C10 and Vermillion yielded Au grades ranging from less than 5 ppb to 205 gpt with 20 samples yielding results over 1 gpt Au ( Figure 4 ).

-

Notable high-grade spot and float vein samples from C10 and Vermillion include:

-

205 gpt Au, 118 gpt Ag, 0.7% Cu

-

75.2 gpt Au, 371 gpt Ag, 1.6% Cu

-

72.7 gpt Au, 79.2 gpt Ag, 1.8% Cu

-

63.3 gpt Au, 165 gpt Ag, 0.6% Cu

-

40.6 gpt Au, 43.5 gpt Ag, 1.4% Cu

-

33.1 gpt Au, 259 gpt Ag, 10.3% Cu

-

32.5 gpt Au, 14.45 gpt Ag, 0.3% Cu

-

24.5 gpt Au, 131 gpt Ag, 0.3% Cu

-

21.7 gpt Au, 19.45 gpt Ag

-

19.3 gpt Au, 3.3 gpt Ag

-

17.0 gpt Au, 11.6 gpt Ag

-

15.95 gpt Au, 55.9 gpt Ag, 2.85% Cu

-

-

Copper occurs as chalcopyrite and bornite in the sulfide assemblage of many samples. This association suggests these veins are possibly associated with a porphyry at depth. Bismuth is moderately to strongly elevated, 0.02-3820 ppm, in samples containing over 1 gpt Au.

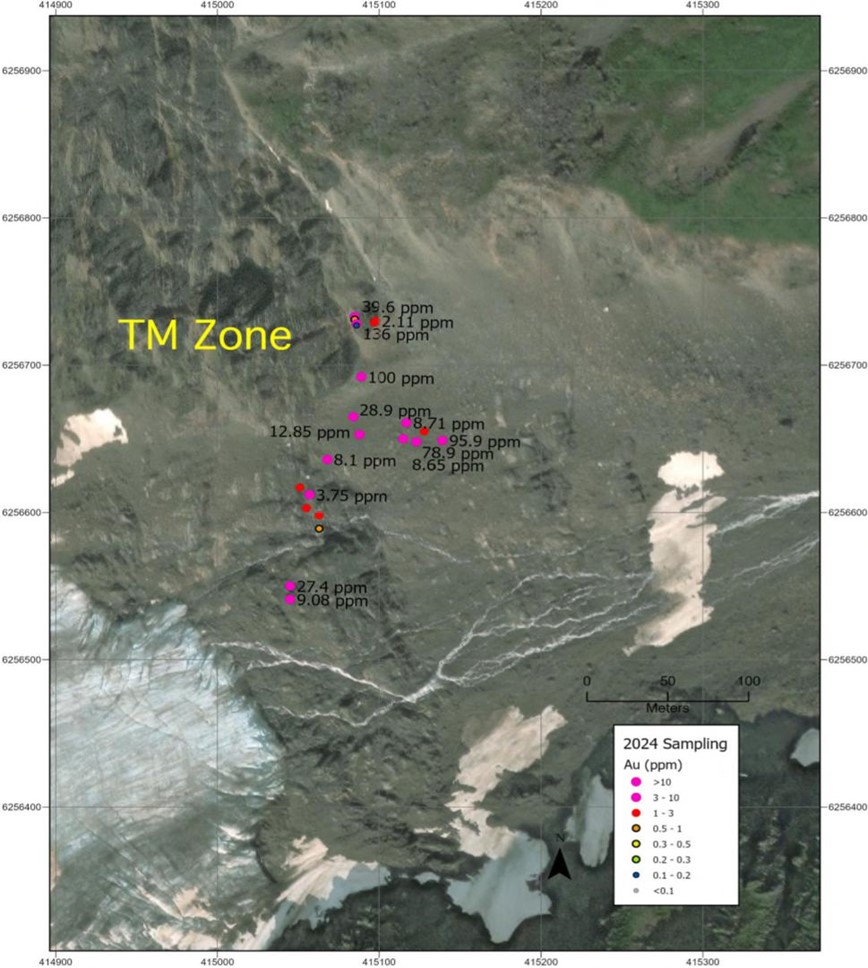

Highlights from the TM Zone

-

Twenty-four rock chip and float samples collected at the TM Zone yielded Au grades ranging from less than 5 ppb to 136 gpt with 19 samples yielding results over 1 gpt Au ( Figure 5 ).

-

Notable high-grade spot and float vein samples from the TM Zone include:

-

136 gpt Au, 175 gpt Ag

-

100 gpt Au, 85.7 gpt Ag

-

95.9 gpt Au, 116 gpt Ag

-

78.9 gpt Au, 44.1 gpt Ag

-

39.6 gpt Au, 33.6 gpt Ag

-

28.9 gpt Au, 278 gpt Ag

-

27.4 gpt Au, 70.4 gpt Ag

-

12.85 gpt Au, 8.02 gpt Ag

-

-

Unlike veins at C10 and Vermillion, veins at the TM Zone display significantly less copper. Bismuth is notably more abundant in samples from the TM Zone, ranging from 26.7-10,001 ppm in samples containing over 1 gpt Au.

-

A stacked sequence of flat veins is present at the TM Zone.

Given the limited amount of time spent at C10, Vermillion and TM Zone, Eskay's team thinks that more discoveries of high-grade veins in the southern part of the Property is likely if more time is dedicated to further prospecting. Therefore, additional work is strongly recommended in this area in 2025 with the goal of adding further vein discoveries as well as better understanding those discovered in 2024 in preparation for drill testing.

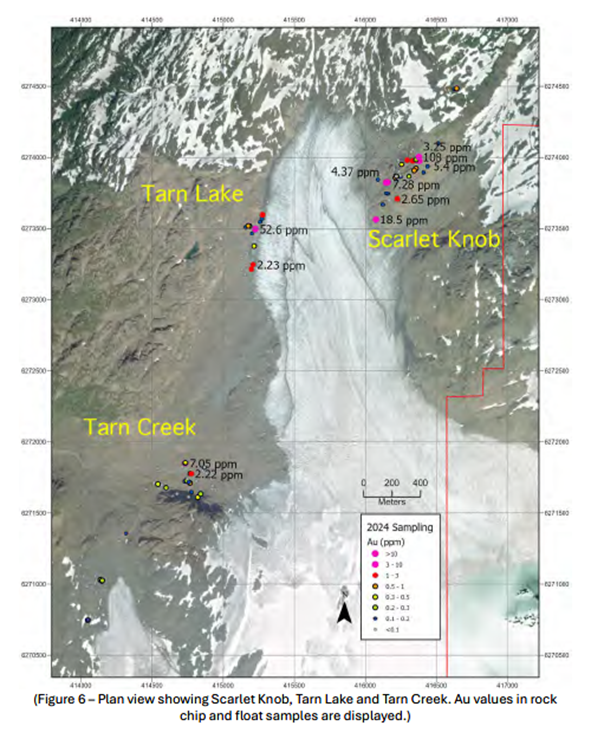

Northeast Region

Eskay's team allocated several days field time to areas that were explored and drilled in 2022 and 2023 at Tarn Lake and Scarlet Knob to better understand the widespread anomalous VMS mineralization that was encountered here. Newly gathered data suggests that there is potentially a strong east-west control to the gossanous zone that extends from Tarn Lake on the west under the glacier to Scarlet Knob on the east. If so, previous drill holes were not optimally oriented to test such a target.

Highlights from Scarlet Knob-Tarn Lake

-

One hundred seven rock chip and float samples collected at Scarlet Knob and Tarn Lake yielded Au grades ranging from less than 5 ppb to 108.0 gpt Au with 14 samples yielding results over 1 gpt Au ( Figure 6 ).

-

Notable rock chip and float vein samples from Tarn Lake and Scarlet Knob include:

-

108 gpt Au, 109 gpt Ag, 2.8% Pb, 1% Zn

-

52.6 gpt Au, 82.8 gpt Ag, 1.8% Pb, 2.7% Zn

-

18.5 gpt Au, 212 gpt Ag, 7.5% Pb, 18.1% Zn

-

-

Strongly elevated lead and zinc occur with most mineralized samples collected in this area.

All mineralized samples collected in the region around Scarlet Knob and Tarn Lake display sulfide assemblages and textures typical of metamorphose VMS mineralization. Given that more high-grade samples of stockwork VMS mineralization were collected in 2024, a clear indication of the potential of this system, Eskay's team recommends that additional drilling should be conducted here to test this newly recognized orientation of the VMS trend.

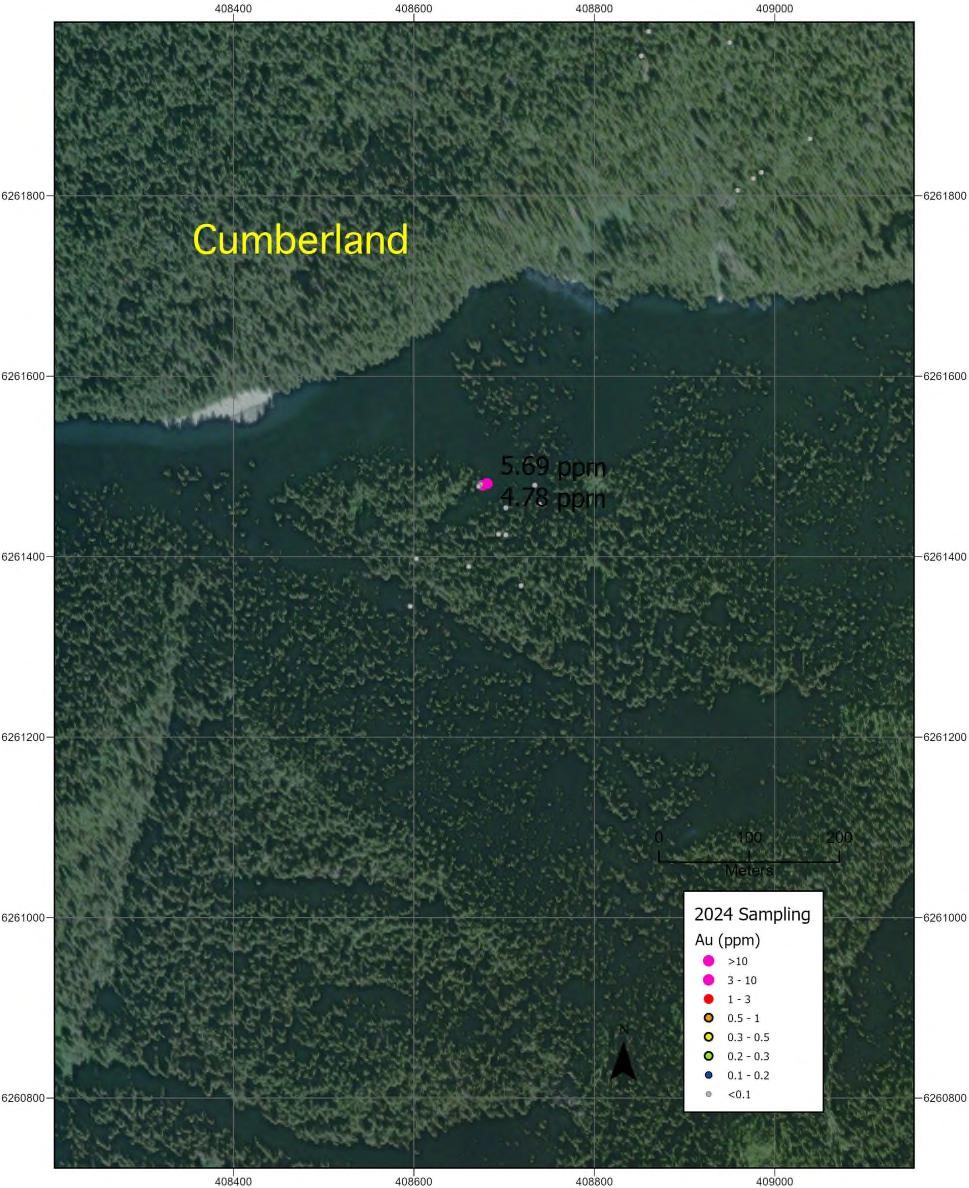

Cumberland

Two days were spent examining the Cumberland prospect, a target successfully drilled by Eskay Mining in 2023 ( Figure 7 ). Detailed in a Company press release dated November 2, 2023, hole CBL23-28 encountered 15m of VMS mineralization grading 3.02 gpt Au, 68.7 gpt Ag, 0.24% Cu, 0.73% Pb and 4.86% Zn. Reexamination of this VMS target indicates it strikes NNW and dips about 70 degrees to the ENE and could potentially extend beyond the area that was drilled. Eskay's team recommends that the target be re-tested by establishing drill pads southeast of the previous pads and drilling a series of northwest-oriented holes.

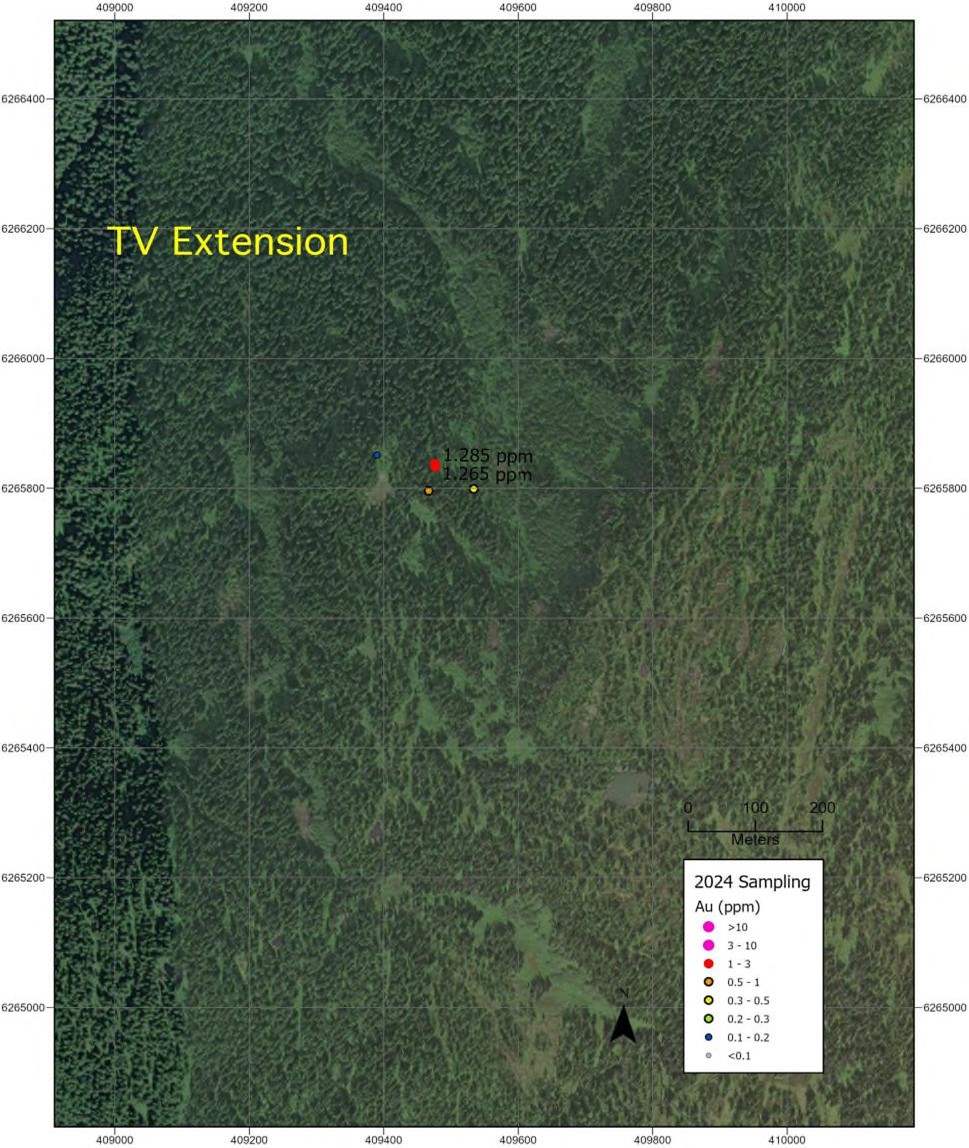

TV Extension

Six outcrop rock chip samples were collected along strike south of the TV deposit yielding Au contents ranging from 0.072 gpt to 1.285 gpt and Ag from 16.7 gpt to 45.9 gpt ( Figure 8 ). During drilling in 2021, a post-mineral gabbro dike was encountered along the southern margin of the TV deposit apparently cutting off mineralization. Based upon these results, Eskay's team thinks more work is warranted in this area and the corridor extending to the Cumberland prospect.

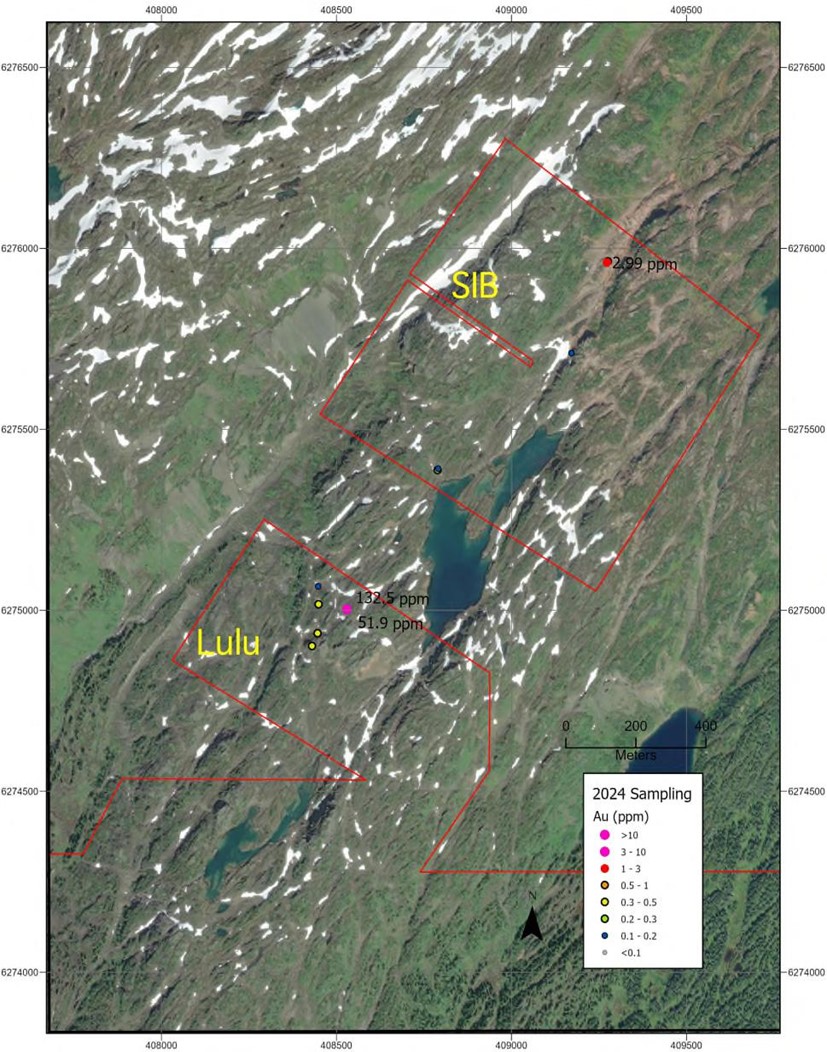

SIB-Lulu Prospect

Situated on the western limb of the Eskay Anticline immediately along strike from the new Eskay Creek mine currently under construction, the SIB-Lulu prospect remains an intriguing target. Sixteen samples, all displaying sulfide mineral assemblages and textures consistent with a metamorphosed VMS origin, yielded Au results ranging from 0.006-132.5 gpt ( Figure 9 ). A notable float sample from Lulu yielded 132.5 gpt Au, 760 gpt Ag and 3.4% Pb, and an outcrop sample yielded 51.9 gpt Au, 290 gpt Ag and 3.3% Pb. An outcrop sample from SIB yielded 2.99 gpt Au and 125 gpt Ag.

SIB-Lulu was the subject of several forays of drilling between the early 1990's and 2018. A review of this historic data by Eskay's team indicates most of this drilling was undertaken with small diameter core, holes were not optimally oriented and were sometimes widely spaced and not all core was sampled for assay. Given the success that Skeena Resources has demonstrated nearby at the Eskay Creek deposit by conducting systematic close-spaced drilling, Eskay Mining's team thinks a similar approach is warranted at SIB-Lulu.

QA/QC Methodology Statement

Rock chip samples were submitted to ALS Geochemistry in Terrace, British Columbia for preparation and analysis. ALS is accredited to the ISO/IEC 17025 standard for gold assays. All analytical methods include quality control standards inserted at set frequencies. The entire sample interval is crushed and homogenized, 250 g of the homogenized sample is pulped. All samples were analyzed for gold, silver, and a suite of 48 major and trace elements. Analysis for gold is by fire assay fusion followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) on 30 g of pulp. Analysis for silver is by fire assay and gravimetric analysis on 30 g of pulp. All other major and trace elements are analyzed by four-acid digestion followed by ICP-MS.

Dr. Quinton Hennigh, P. Geo., a Director of the Company and its technical adviser, a qualified person as defined by National Instrument 43-101, has reviewed and approved the technical contents of this news release.

About Eskay Mining Corp:

Eskay Mining Corp (TSX-V:ESK) is a TSX Venture Exchange listed company, headquartered in Toronto, Ontario. Eskay is an exploration company focused on the exploration and development of precious and base metals along the Eskay rift in a highly prolific region of northwest British Columbia known as the "Golden Triangle," 70km northwest of Stewart, BC. The Company currently holds mineral tenures in this area comprised of 177 claims (52,600 hectares).

All material information on the Company may be found on its website at www.eskaymining.com and on SEDAR+ at www.sedarplus.com .

For further information, please contact:

|

Mac Balkam

|

T: 416 907 4020

|

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This Press Release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such as actual results of current exploration programs, the general risks associated with the mining industry, the price of gold and other metals, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forward-looking statements, except as required by law. Shareholders are cautioned not to put undue reliance on such forward-looking statements .

(Figure 1 - Plan map of the Consolidated Eskay property outlined in red showing various areas that were prospected in 2024. Au results from surface rock chip and float samples are displayed.)

(Figure 2 - Top: example of a 3.5m wide quartz-carbonate-sulfide stockwork in a shear zone

at Vermillion, Bottom: a 30 cm wide quartz-carbonate-sulfide vein at the TM Zone.)

(Figure 3 - A piece of quartz-carbonate-sulfide vein material from a select sample collected at Vermillion. This sample grades 205 gpt Au and 0.7% Cu. The vein was traced along surface for approximately 200m.)

(Figure 4 - Plan view showing the C10 and Vermillion prospect areas. Au values in rock chip and float samples are displayed. All high-grade samples originate from quartz-carbonate- sulfide vein material.)

(Figure 5 - Plan view showing the TM Zone. Au values in rock chip and float samples are displayed. All high-grade samples originate from quartz-carbonate-sulfide vein material.)

(Figure 7 - Plan view showing Cumberland prospect. Au values in rock chip and float samples are displayed.)

(Figure 8 - Plan view showing the TV prospect. Au values in rock chip and float samples are displayed.)

(Figure 9 - Plan view showing the SIB and Lulu prospects. Au values in rock chip and float

samples are displayed.)

SOURCE: Eskay Mining Corp.

View the original press release on accesswire.com