Founders Metals Extends Buese Gold Mineralization over 1,000 m & Intersects 21.6 m of 2.38 g/t Au

April 23, 2025

NioCorp to Initiate Drilling Program at Elk Creek Project in Order to Support Updated Feasibility Study

April 23, 2025

Excellon Announces Upsize of Brokered Private Placement of Units for Gross Proceeds of up to C$7.0 Million

April 23, 2025

Canada Nickel Welcomes Ontario Legislation Supporting Responsible Critical Mineral Development

April 23, 2025

Ivanhoe Mines to Issue Q1 2025 Financial Results After Market Close on April 30 and Host a Conference Call for Investors on May 1, 2025

April 23, 2025

GoldMining Inc. Identifies Significant Antimony Mineralization Including 2.79 g/t AuEq (0.71 g/t Au and 0.59% Sb) over 79 metres and 1.91 g/t AuEq (1.56 g/t Au and 0.10% Sb) over 128 metres at its 100% Owned Crucero Project

April 23, 2025

INVESTOR ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Endeavour Silver Corp. - EXK

April 23, 2025

Sierra Metals and Alpayana Reach Agreement in Principle for CDN $1.15 All-Cash Supported Take-Over Bid and Extends Offer

April 23, 2025

Triple Flag Announces Increase in Credit Facility Availability to US$1 Billion at Improved Terms

April 23, 2025

Eagle Plains Partner Earthwise Completes Data Review of the Iron Range Gold Project, British Columbia

April 23, 2025

Perpetua Resources Corp. (PPTA) Investors Who Lost Money Have Opportunity to Lead Securities Fraud Lawsuit

April 23, 2025

Silvercorp Announces the Construction Plan and Schedule for the Development of the El Domo Project

April 23, 2025

Northern Graphite Receives Letter of Support from Port of Rotterdam for Baie-Comeau Battery Anode Material Facility

April 23, 2025

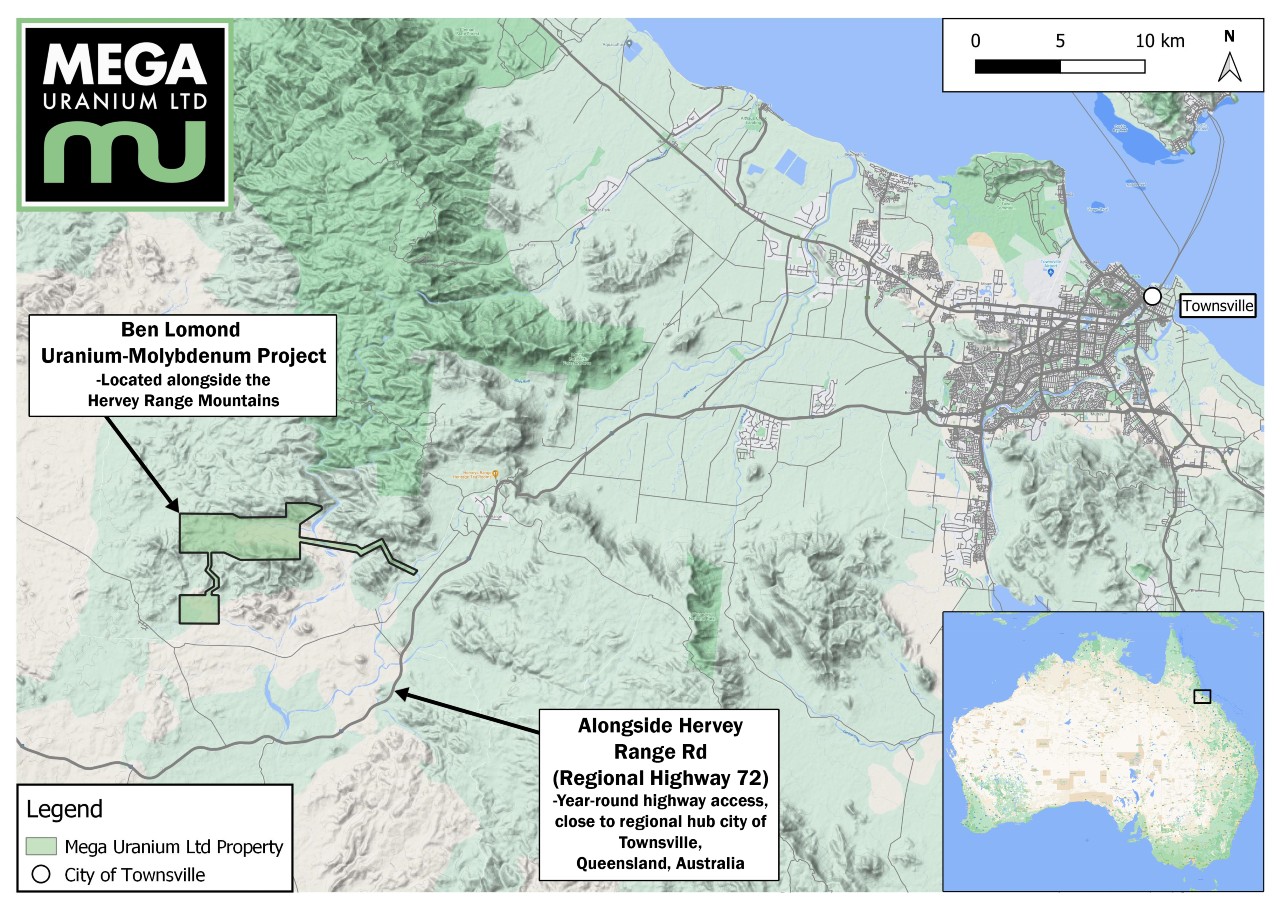

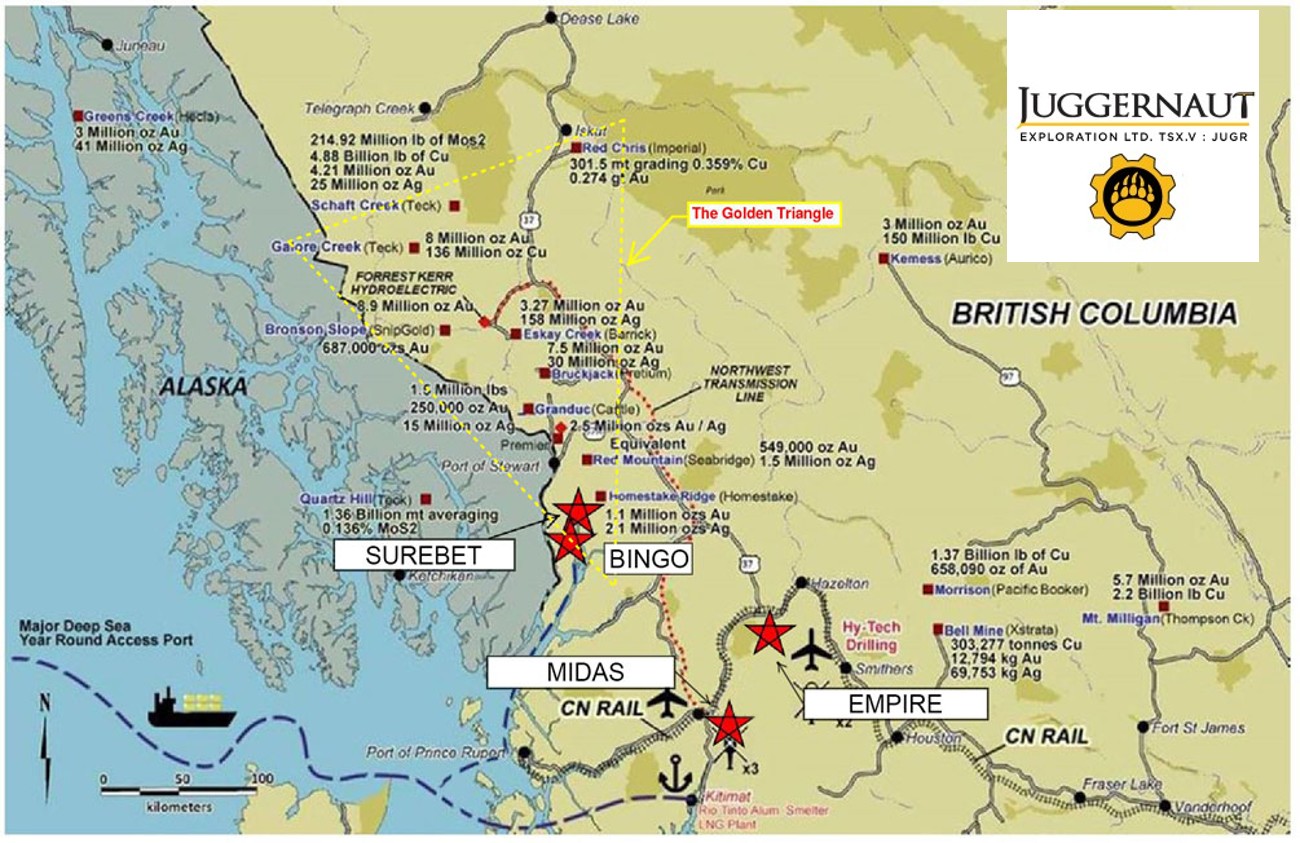

Juggernaut Increases Oversubscribed Financing to $8,600,000 due to Strong Demand from Institutions and Accredited Investors

April 23, 2025

Graphite One Advances its United States Graphite Supply Chain Solution with Completion of a Bankable Feasibility Study

April 23, 2025

B.C. Government Files Responses to Petitions Challenging KSM's Substantially Started Designation

April 23, 2025

Tartisan Nickel Corp. Completes Phase 1 Construction on the Kenbridge Nickel Project All-Season Access Road

April 22, 2025

Skeena Announces Positive Judgment by the Supreme Court of Canada Regarding the Albino Lake Storage Facility

April 22, 2025

Ascot Announces Leadership Transition and Names Christopher Park as Interim Chief Financial Officer

April 22, 2025

Astra Exploration Receives $1,025,000 from Early Exercise of Warrants, and Commences Drilling at La Manchuria, Argentina

April 22, 2025

Fortuna to release first quarter 2025 financial results on May 7, 2025; Conference call at 12 p.m. Eastern time on May 8, 2025

April 22, 2025

Alaska Energy Metals Files Updated NI 43-101 Technical Report for The Eureka Deposit, Nikolai Nickel Project, Alaska, USA

April 22, 2025

Hecla's Libby Exploration Project Selected for FAST-41 Critical Minerals Dashboard by the Trump Administration

April 22, 2025

American Pacific Commences Drill Program at the Madison Copper-Gold Project in Montana

April 22, 2025

INTEGRA ANNOUNCES STRONG FIRST QUARTER 2025 GOLD PRODUCTION RESULTS FROM FLORIDA CANYON MINE AND INCREASED CASH BALANCE TO US$61 MILLION

April 22, 2025

ATHA Energy Announces Closing Of Financing For Aggregate Gross Proceeds Of $10,000,000

April 22, 2025

Pike Zone Drillhole WMA079-01 Intersects 8.3 Metres at 24.82% eU3O8; Including 5.5 Metres at 37.09% eU3O8

April 22, 2025

Tudor Gold Increases Overall Gold Recoveries to Over 80%, Produces a High-Grade Copper, Gold and Silver Concentrate for the Goldstorm Deposit at Treaty Creek, Northwestern B.C.

April 22, 2025

ESGold Actively Engaged with Government Partners as Montauban Moves Toward Production

April 22, 2025

Inspiration Energy Corp. Secures U.S. Listing, Eyes Global Growth and Exploration Upside

April 22, 2025

Scorpio Gold Closes Over-Subscribed Final Tranche of Private Placement, Bringing Gross Proceeds Raised to Over $7 million

April 22, 2025

Precipitate Trenching Expands Centro Zone with 4.4% Copper over 1.8 metres at the Juan de Herrera Project, Dominican Republic

April 22, 2025

Newcore Gold Drilling Intersects 2.50 g/t Gold over 15.0 Metres and 3.00 g/t Gold over 10.0 metres at the Enchi Gold Project, Ghana

April 22, 2025

Benton Identifies Large, Deep Conductive Electro Magnetic Plates Associated with Known Mineralized Zones at South Pond

April 22, 2025

ROSEN, A RANKED AND LEADING LAW FIRM, Encourages Eldorado Gold Corporation Investors to Inquire About Securities Class Action Investigation - EGO

April 22, 2025

Triple Flag to Acquire Orogen Royalties and Its 1.0% NSR Royalty on the Expanded Silicon Gold Project

April 22, 2025

Exploration Drilling Intersects 983 g/t over 3.4m at Galena, Driving Growth of Potential New Mining Zone in High-Grade 034 Vein & Tara Hassan Appointed To Board of Directors

April 22, 2025

Solaris completes Warintza drilling campaign and advances key de-risking milestones ahead of major near-term value catalysts

April 22, 2025

Decade Receives Approval for Purchase of the North Mitchell Property in Golden Triangle Surrounded by Reported Resources of 200 Million Gold Equivalent Ounces

April 21, 2025

Sage Potash Appoints Tim Mizuno as President and Chief Operating Officer and Announces Loan Agreement

April 21, 2025

Smackover Lithium's South West Arkansas Project Receives Special Designation as a Priority Transparency Critical Mineral Project From the Trump Administration

April 21, 2025

North Peak Announces a $5.17 Million Closing for Previously Announced Private Placement

April 21, 2025

Kinaxis Launches Tariff Response Solution to Help Supply Chains Adapt to Disruption with Confidence

April 17, 2025

Awalé Hits 12 g/t Gold over 26 Metres Among Multiple High-Grade Intercepts at the Charger Target, Odienné Project

April 17, 2025

U.S.-Based Energy Fuels Poised to Produce Six of the Seven Rare Earth Oxides Now Subject to Chinese Export Controls at Scale

April 17, 2025

Silver Elephant Upsizes Previously Announced Private Placement to $540,000 and Amends Terms

April 17, 2025

Ashley Gold Closes Oversubscribed Unit Private Placement & Announces Completion of Icefield Acquisition

April 17, 2025

Westhaven Files Technical Report in Support of Updated Preliminary Economic Assessment for the Shovelnose Gold Project, British Columbia

April 17, 2025

Power Metallic Expands the Tiger Zone - First Indications of Lion Style Copper Dominant Mineralization at Tiger

April 17, 2025

Red Lake Gold Inc. Reports Additional Asubpeeschoseewagong Anishinabek Correspondence

April 16, 2025

Cassiar Gold's Field Campaign Confirms Extension of Gold Showings and Defines Multiple New Exploration Targets

April 16, 2025

Newmont Completes Its Non-Core Divestiture Program With the Sale of Akyem and Porcupine

April 16, 2025

GoviEx Advances the Muntanga Uranium Project with Submission of Draft Environmental and Social Impact Assessment to Zambian Environmental Agency

April 16, 2025

E3 Lithium Provides Demonstration Plant Progress Update, Reminder of Webinar Today at 9am MT

April 16, 2025

Golden Rapture Mining Commences Exploration at its High-Grade Phillips Township Property

April 16, 2025

AMENDED FROM SOURCE - Blue Sky Uranium Increases and Closes 2nd and Final Tranche of the Oversubscribed Non-Brokered Private Placement

April 16, 2025

RUA GOLD Expands High-Grade Intercepts at Depth at Auld Creek: 5.9g/t AuEq over 9m and 48.3g/t AuEq over 1.25m

April 16, 2025

Global Energy Metals Partner Receives Collaborative Exploration Initiative Grant For Millennium Copper Cobalt Gold Graphite Project

April 16, 2025

Eloro Resources Intersects Significant Intervals of Silver and Tin-rich Mineralization in Step-out Drilling at its Iska Iska Ag-Sn-Polymetallic Project, Potosi Department, Bolivia

April 15, 2025

Clean Air Metals Continues to Expand High-Grade Zones at Current Deposit, Intersects 7.8m of 4.86 g/t Pt, 4.77 g/t Pd and 1.05% Cu

April 15, 2025

Nations Royalty and Nisga'a Nation Release Groundbreaking Documentary: Nations Rising

April 15, 2025

Galway Drilling Extends Gold Mineralization 300 Meters at the Southwest Deposit, and 350 Meters at the North Deposit

April 15, 2025

LIBERO COPPER ANNOUNCES CLOSING OF THE WARRANT INCENTIVE PROGRAM RAISING GROSS PROCEEDS OF CDN$1,660,847

April 15, 2025

Strategic Investor Crescat Capital to Participate in Condor's Private Placement of up to $1.5 Million

April 15, 2025

Cerrado Gold Announces Q1 2025 Production Results At Its Minera Don Nicolas Mine In Argentina

April 15, 2025

New Found Gold Corp. Provides Queensway Gold Project Overview and Plans; Files Technical Report

April 15, 2025

Atlas Salt Completes Geotechnical Drilling and In-Field Data Collection for Great Atlantic Salt Project

April 14, 2025

Giga Metals Completes Additional Tranche of Private Placement and Provides Additional Information on First Tranche

April 14, 2025

LithiumBank Confirms up to 95% Lithium Recovery and over 99% Impurity Rejection from DLE Pilot Testing Using SLB's Integrated Lithium Production Solution Technology on Boardwalk and Park Place Brines

April 14, 2025

Snowline Gold Announces Expansion of Leadership Team with Appointment of VP Engineering and Transition of Chief Financial Officer

April 14, 2025

Bayhorse Silver Commences Drilling At 30M By 40M IP Target Below Historic High Grade Silver Sunshine Stope At The Bayhorse Silver Mine, Oregon, USA

April 14, 2025

Gold Terra Closes First Tranche of Financing Package with Support from Osisko Gold Royalties

April 11, 2025

Headwater Gold Acquires the Whiskey Project in Nevada and Reports 19.2 g/t Au in Rock Samples at Surface

April 10, 2025

Centerra Gold Provides Notice of First Quarter 2025 Results and Conference Call and Details for Annual Meeting of Shareholders

April 10, 2025

Wesdome Announces First Quarter 2025 Production; Provides Timing of First Quarter Financial Results and Webcast

April 10, 2025

NexGold Intersects High-Grade Gold Mineralization at Goliath West and Extends Gold Mineralization at the Far East Prospect

April 10, 2025

Standard Uranium Announces Strategic Partnership with Fleet Space and Multiphysics Surveys on Flagship Davidson River Project

April 10, 2025

Viscount Mining Identifies Key Copper Porphyry Indicators at Passiflora Project in Silver Cliff, Colorado

April 10, 2025

NevGold Discovers More Significant Oxide Gold-Antimony Results: 1.70 g/t AuEq Over 169.2 Meters (0.89 g/t Au And 0.18% Antimony), Including 2.85 g/t AuEq Over 54.4 Meters (2.26 g/t Au And 0.13% Antimony), and Also Including 13.15 g/t AuEq Over 3.1 Meters (0.76 g/t Au And 2.76% Antimony) at the Limousine Butte Project, Nevada

April 10, 2025

Antero Resources Announces First Quarter 2025 Earnings Release Date and Conference Call

April 9, 2025

Heliostar Drills 8.85 Metres Grading 25.0 g/t Gold and 768 g/t Silver at the La Colorada Mine, Sonora, Mexico

April 9, 2025

Pan American Silver to Announce First Quarter 2025 Unaudited Results and Host Annual General and Special Meeting of Shareholders on May 7

April 9, 2025

AT&T to Provide Fiber Connectivity for Jericho Energy Ventures' Inaugural AI Modular Data Center Site

April 9, 2025

1911 Gold Successfully Re-Enters the True North Mine and Receives Manitoba Mineral Development Fund Grant

April 9, 2025

Starcore Updates on Exploration at Kimoukro Gold Project in Cote d'Ivoire - Soil Geochemistry and Auger Drilling Campaign

April 9, 2025

The Cree Trappers Association, the Cree Hunters Economic Security Board and Mining & Exploration Companies Approve 2025 Funding to Continue the Reconstruction of Cabins Burnt during the 2023 Forest Fires, James Bay, Quebec

April 9, 2025

Cerro de Pasco Resources Announces Consolidated Assays of the Drilling Campaign at Quiulacocha Tailings Project, Confirms High-Grade Mineralization, including Significant Gallium Concentrations

April 9, 2025

Arizona Gold & Silver Announces High Gold Grades in Core Drill Hole PC25-136 at the Philadelphia Project, Arizona

April 8, 2025

OceanaGold Provides Notice of First Quarter 2025 Results and Conference Call, and Annual General and Special Meeting of Shareholders

April 8, 2025

Westward Gold Announces Closing of Oversubscribed Non-Brokered Private Placement Financing; Strategic Investor Crescat Capital LLC Acquires 10.3% Stake

April 8, 2025

Sandstorm Gold Royalties Reports Strong First Quarter Sales and Record Revenue, $19 Million in Share Buybacks; Financial Results May 6

April 8, 2025

Coast Copper Acquires Ground in the Toodoggone, Adjacent to Amarc, Centerra and TDG Gold

April 8, 2025

NCMI Applauds JOGMEC investment into Rare Earth Separation and Provides Update on Accelerated Value Engineering at Lofdal Dysprosium-Terbium Project

April 8, 2025

Grande Portage Announces Outstanding Results from Sensor-Based Ore Sorting Testwork, with Gold Grade of Sample Increased by 120%

April 8, 2025

Leishen Energy Holding Co., Ltd is trying to make a strategic layout in Middle East as a production base for overseas market

April 7, 2025

Enterprise Group Announces New $41 Million Credit Facility with a Canadian Schedule 1 Bank

April 7, 2025

C3 AI and Arcfield Announce Partnership to Accelerate AI Capabilities to Serve U.S. Defense and Intelligence Communities

April 3, 2025

P2 Gold Announces Positive Sullivan Zone Sample Assay Results from Gabbs Project; Commences Further Metallurgical Testwork

April 3, 2025

Alamos Gold Announces the Sale of Quartz Mountain Gold Project for Total Consideration of up to $21 million and 9.9% Equity in Q-Gold Resources

April 3, 2025

Golden Arrow Files Technical Report for San Pietro Copper-Gold-Iron-Cobalt Project, Chile

April 3, 2025

Northern Graphite and Graphano Energy Announce Strategic Collaboration for Graphite Resource Development

April 2, 2025

Albemarle Corporation to Release First Quarter 2025 Earnings Results on Wednesday, April 30, 2025

April 2, 2025

Trigon Metals Provides Update on the Sale of its Ownership Interest in the Kombat Mine, Namibia

April 2, 2025

Scottie Reaches Major Milestone with Positive Results from Ore Sorting Study and Announces DSO Project

April 1, 2025

Terra Clean Energy Corp. Completes Winter Drill Program With Encouraging Results; Plans Significant Summer Drill Program

April 1, 2025

Skyharbour Partner Company Terra Clean Energy Completes Winter Drill Program with Encouraging Results and Prepares a Significant Summer Drill Program at the South Falcon East Uranium Project

April 1, 2025

THE Mining Investment Event - Quebec City, June 3-5, 2025 Announces Glencore Canada Exclusive Diamond Sponsor New Sponsors and Participating Issuers

March 31, 2025

Revival Gold Delivers Compelling PEA Results and Attractive Potential Re-development Timeline for the Mercur Gold Project

March 31, 2025

Volt Lithium and Wellspring Hydro Enter Into Field Development Agreement Backed by Follow-On Grant from State of North Dakota

March 31, 2025

VIZSLA SILVER MAKES NEW HIGH-GRADE DISCOVERY IN THE NORTH EAST OF PANUCO INTERSECTING 897 G/T AGEQ OVER 5.85 METERS INCLUDING 2,256 G/T AGEQ OVER 1.13 METERS

March 31, 2025

Temas Announces Engagement Of PAC Partners Securities Pty Ltd & Proposed Australian Stock Exchange Listing

March 31, 2025

FRONTIER LITHIUM FINALIZES THE CONTRIBUTION AGREEMENTS FOR THE CRITICAL MINERALS INFRASTRUCTURE FUND

March 31, 2025

Bravada Gold Looks to Accelerate the Past-Producing Wind Mountain Gold/Silver Mine in Nevada Toward Renewed Production Following Executive Order to Prioritize US Mining

March 31, 2025

Generation Mining Announces Filing of Marathon Copper-Palladium Project Technical Report

March 28, 2025

VIQ Solutions Delivers $6.0M Adjusted EBITDA Year-Over-Year Improvement in FY 2024, fueled by AI-Driven Automation, Cost Optimization, and Strategic Customer Contract Renewals

March 28, 2025

Gold Springs Resource Corp. Files 2024 Financial Statements, MD&A and Annual Information Form

March 28, 2025

Americas Gold and Silver Announces Full-Year 2024 Results Ahead of a Transformational Year Underway in 2025

March 27, 2025

METALLA REPORTS FINANCIAL RESULTS FOR THE 2024 FISCAL YEAR AND PROVIDES ASSET UPDATES

March 27, 2025

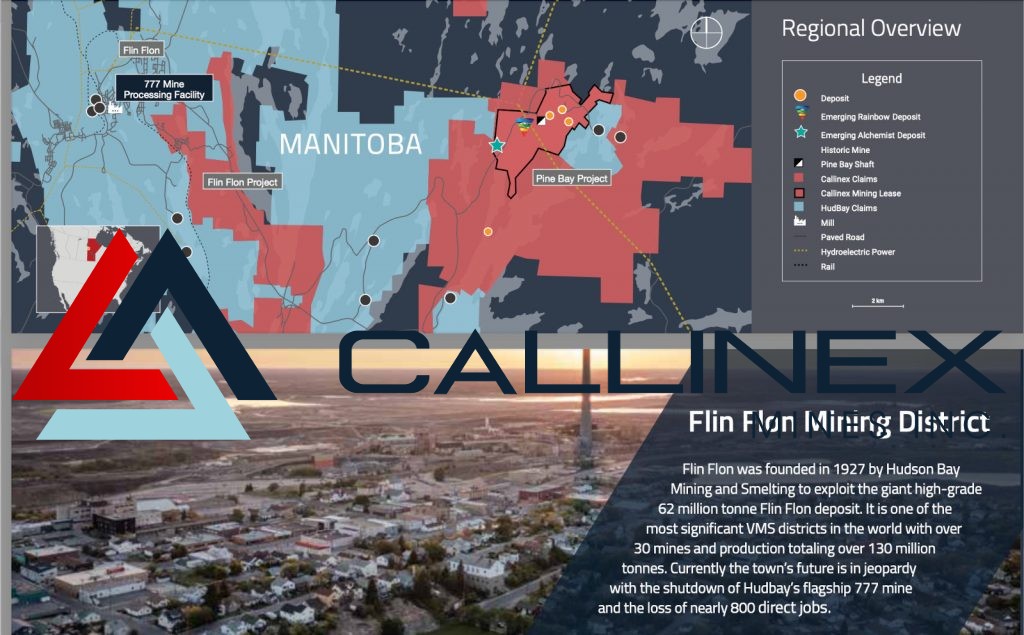

Callinex Targets Expanding Historic High Grade Copper and Gold Deposits Near Surface in the Flin Flon Mining District, MB

March 25, 2025

Silver Storm Files NI 43-101 Technical Report for the La Parrilla Silver Mine Complex, Durango State, Mexico

March 24, 2025

Strategic Investors Crescat Capital and Mr. Rob McEwen Participate In $3,157,193 Exercise Of Goliath Resource Warrants

March 21, 2025

Almaden Files Memorial Documentation for US$1.06 billion Damages Claim Against Mexico

March 21, 2025

Atco Mining Announces Agreement to Acquire Staque's Super Computing Software Platform - "Super"

March 21, 2025

Strategic Investors Crescat Capital and Mr. Rob McEwen Participate In $3,157,193 Exercise Of Goliath Resource Warrants

March 21, 2025

Provenance Gold Completes Drone-Based Airborne Magnetic Survey at the Eldorado Project

March 20, 2025

Summa Silver Announces Mogollon Project Anniversary Payment pursuant to Amended Lease Agreements

March 19, 2025

Q2 Metals Intercepts 179.6 Metres of Continuous Spodumene Pegmatite in Large Step-Out at the Cisco Lithium Project in Quebec, Canada

March 19, 2025

Faraday Copper Intersects 56.57 Metres at 0.59% Copper at Boomerang and 18.49 m at 0.98% Copper at Banjo

March 19, 2025

Reyna Silver Announces Final Tranche Closing of Previously Announced Non-Brokered Private Placement

March 14, 2025

Nevada Sunrise to Leverage VRIFY's AI-Assisted Mineral Discovery Platform at the Past-Producing Griffon Gold Mine Project, Nevada

March 13, 2025

Tower Contracts Diamond Drill to Fine-Tune the High-Grade Blue Sky, Thunder, and Thunder North Gold Discoveries in Preparation for a Larger, 3000-m Test of the Overall Rabbit North Gold System

March 13, 2025

Relevant Gold Closes Second Tranche of Upsized $8.5 Million Non-Brokered Private Placement Led by Strategic Investors Kinross and Bollinger

March 13, 2025

Diamond Drilling Intercepts 15 Metres Grading 3.02 g/t Gold-Equivalent on the Loma Verde Vein on the Coneto Gold-Silver Project in Durango, Mexico

March 12, 2025

Kobo Resources Expands Exploration Portfolio in Côte d'Ivoire with New Earn-In Agreements and License Applications

March 4, 2025

FireFox Gold Summarizes New Anomalies and Ongoing Exploration at its Kolho Property, Finland

March 4, 2025

Preparation Underway to Restart Exploration at Holly Property with a Focus on Increasing the High-grade Resource

March 3, 2025