Writer: Kevin Dwyer CEO,Head Trader

Writer: Kevin Dwyer CEO,Head Trader May 15, 2024

Stock Chart Global Energy Metals

A VANGUARD IN THE ELECTRIFIED ECONOMY: GLOBAL ENERGY METALS CORP.

INTRODUCTION TO GLOBAL ENERGY METALS CORP.

In an era increasingly defined by the thrust towards renewable energy and sustainable practices, Global Energy Metals Corp. emerges as a frontrunner providing a distinct investment opportunity within the rechargeable battery and electric vehicle market. Founded on April 27, 2015, and rooted in Vancouver, Canada, this trailblazing entity is committed to the development of a diversified global portfolio, with a strong emphasis on exploring and expanding within the realm of battery minerals. The burgeoning demand for such minerals, driven by the electrification of transportation and a broader economic shift, underscores the pivotal role that companies like Global Energy Metals Corp. assume in forging a sustainable future.

SUSTAINING THE ELECTRIFICATION REVOLUTION

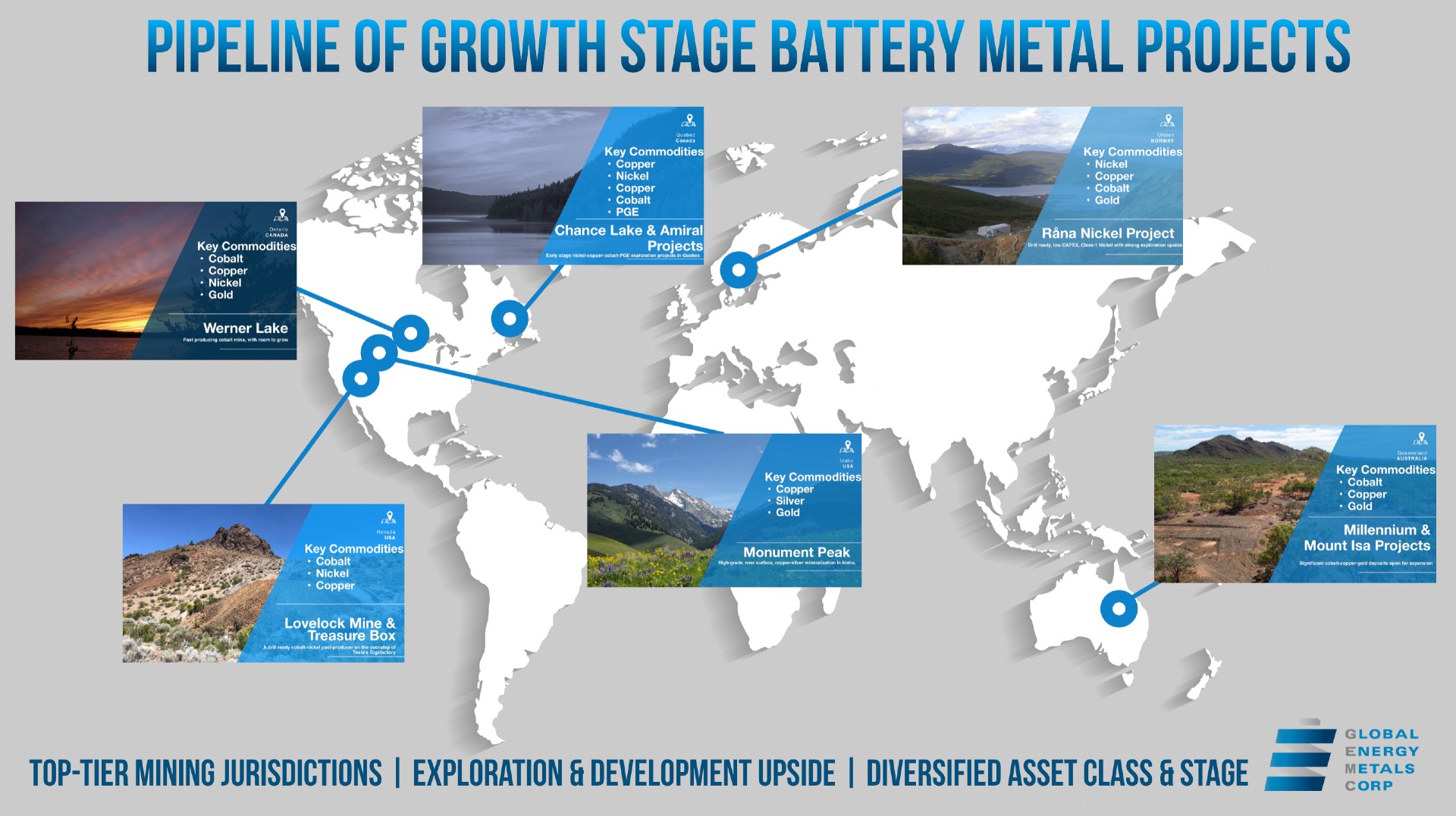

The ongoing revolution in electrification continues to advance at an unyielding pace, bringing about fundamental changes in our patterns of energy consumption. At the core of this transformation is the availability of vital battery metals such as cobalt, nickel, copper, lithium, among others. Keenly aware of the magnitude of these developments, Global Energy Metals pursues a robust 'consolidate, partner and invest' strategy, seeking to secure significant investments within the resources essential to this global transition. Highlighting the company’s shrewd strategic moves are asset acquisitions and project developments such as Millennium Cobalt, Lovelock Mine & Treasure Box, and the Werner Lake Cobalt project—all of which exemplify its commitment to operational excellence and foresightedness.

STRATEGIC PROJECT DEVELOPMENT

Global Energy Metals has demonstrated a remarkable ability in pinpointing prospective assets within leading mining and processing regions across the globe. Spearheading ventures in Canada, Australia, Norway, and the United States underscores the company’s resolve to establish itself at the core of mining progression and end-use markets. With a clear strategic intent, these projects are selected based on their scalability and the relatively low logistical and processing risks involved, which are advantages that facilitate rapid integration into the global supply chain.

ADDRESSING ENVIRONMENT & SUPPLY CHAIN CHALLENGES

A fundamental goal of Global Energy Metals resides in confronting environmental challenges by propelling the development of clean energy technologies. Through partnerships with industry peers, the company underscores its dedication to core commodities that play an indispensable role in realizing a cleaner, more energy-efficient future. The pursuits of Global Energy Metals Corp. extend beyond mere profit generation to embody a holistic commitment to promoting the responsible use of natural resources and contributing to an environmentally conscious tomorrow.

CORPORATE LEADERSHIP & VISION

Guiding Global Energy Metals at its forefront is Mitchell Smith, the esteemed Founder, President and CEO. Mr. Smith brings over fifteen years of executive leadership experience, marked by an enduring enthusiasm for the natural resources sector. As a Director of the Battery Metal Association of Canada, his voice carries significant weight in advocating for Canada’s informed use of its abundant battery resources. Mr. Smith's informed leadership, accentuated by a nuanced comprehension of the battery supply chain, has driven the successful acquisition and progress of valuable mining projects on an international scale.

INSIGHTFUL INDUSTRY CONTRIBUTIONS

Mitchell Smith's astute commentaries on energy storage, renewable energy, and his advisory involvements in various resource companies have established his reputation as a key influencer within the industry. His expert perspectives on the security of critical mineral supply chains and renewable energy developments have become resources for eminent global news platforms including The Financial Times, Bloomberg, and Reuters. Mr. Smith's recognition as one of the top influencers in the battery minerals sector serves as a testament to his expertise and the prominence of Global Energy Metals as an industry pioneer.

CONCLUSION: THE ELECTRIFICATION NARRATIVE

Expanding into critical minerals that drive the eMobility revolution delineates more than a mere business endeavour; it represents a vital call for generational responsiveness. Global Energy Metals Corp. stands as a tangible embodiment of this profound shift, appreciating the fact that the opportune moment to act is now. Through strategic partnerships, astute investments, and a dedicated focus on the extension of the battery metal supply network, the company is solidifying its position as a pioneering force within the electrified economy. By championing such innovative and ecologically responsible initiatives, Global Energy Metals ensures that the future of energy extends beyond aspirational visions to become a tangible reality.

Investment Disclosure

The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada