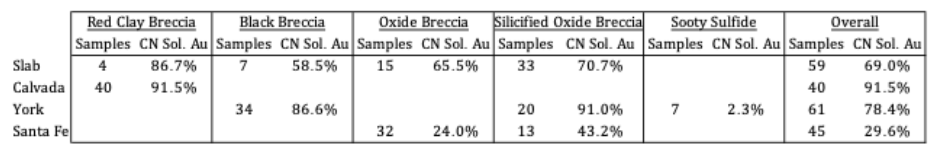

TORONTO, ON / ACCESSWIRE / September 5, 2024 / Lahontan Gold Corp (TSXV:LG)(OTCQB:LGCXF) (the "Company" or "Lahontan") is pleased to announce results from metallurgical test work spread across all four deposits at the Company's 26-km2 Santa Fe Mine project located in Nevada's prolific Walker Lane gold and silver belt. A total of 205 pulp samples from previous Lahontan drilling representing five of the principal mineralization types present throughout the Santa Fe Mine project area, were subjected to cyanide ("CN") shake analysis to determine the amount of CN-soluble gold in the samples and pregnant solution robbing ("preg-robbing") analysis to identify/eliminate any potential problem areas for preg-robbing in the four deposits. The test work was completed by Kappes, Cassiday and Associates ("KCA") of Reno, Nevada, a global leader in metallurgical and process consulting. Highlights of the test work are described below and in the subsequent table:

-

Calvada Deposit: The CN-soluble gold analyses show a potential upside in gold recovery compared to previously reported metallurgical results with 91.5% of the fire-assayed gold to be CN-soluble compared to the currently estimated gold recoveries of 71% (please see Lahontan press release dated January 22, 2024). Additional metallurgical test work including bottle-roll and column leach tests are planned to follow up on the potential shown by CN-solubility analyses.

-

York Deposit: York samples also demonstrated a potential upside in gold recovery, with up to 91.0% of the fire-assayed gold to be CN-soluble and averaging 78.4% compared to the currently estimated gold recoveries of 60% (please see Lahontan press release dated January 22, 2024).

-

Slab Deposit: CN-soluble gold analysis for Slab were elevated compared to previous test work, averaging 69.0% of fire-assayed gold compared to the currently estimated 50% gold recovery (please see Lahontan press release dated January 22, 2024). Additional testing is planned to further optimize recoveries.

-

Santa Fe Deposit: Sampling concentrated on two mineralization types and CN-soluble gold contents were moderate compared to previous test work. Additional test work, including mineralogical analysis, are planned for these two mineralization types.

Preg Robbing Potential: Only three of 205 samples analyzed exhibited aggressive preg robbing potential (Santa Fe deposit), with one showing moderate preg-robbing (Slab deposit, although this sample maintained high cyanide solubility of fire-assayed gold, which makes the preg-robbing result questionable). Preg-robbing is determined by comparing the results of a standard cyanide shake test with that obtained by spiking the leach solution with a known amount of soluble gold providing a semi-quantitative assessment of preg-robbing, typically referred to as the preg-robbing index (PRI) or preg-robbing percentage.

Kimberly Ann, Lahontan Founder, CEO, President, and Director commented: "The Company is excited to receive these results from KCA which continue to confirm the high potential recoveries from oxide gold mineralization at the Santa Fe Mine Project. The absence of any significant preg-robbing potential across multiple mineralization types bodes well for future mine operations. We will continue met testing based on recommendations from KCA to further optimize the processing flow sheet which will be utilized in our upcoming Preliminary Economic Assessment that will analyze the economic upside of resuming precious metal production at Santa Fe."

A summary table of results of CN-soluble gold analysis from 205 pulp samples taken from all four deposits at the Santa Fe Mine Project is shown above. The samples were selected based upon the desire for additional data for mineralization types that were underrepresented in previous metallurgical test work. CN soluble gold percentage ("%") is the percent of fire-assayed gold that is soluble with CN.

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 26.4-km2 Santa Fe Mine project, had past production of 356,000 ounces of gold and 784,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Division of Minerals, www.ndomdata.com). The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,112,000 oz Au Eq(grading 1.14 g/t Au Eq) and an Inferred Mineral Resource of 545,000 oz Au Eq (grading 1.00 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report*). The Company will continue to aggressively explore Santa Fe during 2024 and complete a Preliminary Economic Assessment evaluating development scenarios to bring the Santa Fe Mine back into production. The technical content of this news release and the Company's technical disclosure has been reviewed and approved by Kenji Umeno, P.Eng., of Kappes, Cassiday and Associates, who is a Qualified Person as defined in National Instrument 43-101 -- Standards of Disclosure for Mineral Projects. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the Santa Fe Project Technical Report, Authors: Trevor Rabb and Darcy Baker, P. Geos. Effective Date: December 7, 2022, Report Date: March 2, 2023. The Technical Report is available on the Company's website and SEDAR.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email:

Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

SOURCE: Lahontan Gold Corp

View the original press release on accesswire.com