Writer: Kevin Dwyer, CEO & Head Trader

Writer: Kevin Dwyer, CEO & Head Trader September 22, 2023

COPPER MARKETS UNDER PRESSURE: AN OVERVIEW OF DEVELOPMENTS IN THE COMMODITIES SECTOR

In the industrial world, copper is king. It is an integral component of many industries due to its remarkable properties, including high thermal and electrical conductivity corrosion resistance and is easy to alloy and recycle. It is, therefore, no surprise that fluctuations in the copper market can stand as significant indicators for the state of global industry and the economy at large. However, like other commodities markets, copper also reels from the impact of unforeseen market manipulations or economic factors, as has been evident in recent developments.

In September, Copper futures fell towards the $3.6 per pound mark - a low not seen since late May. This was primarily attributed to renewed pressure from a robust dollar and a weak industrial sentiment worldwide. Despite occasional upturns in industrial growth and fresh loans in China, the largest consumer of copper, persistent fears over the financial well-being of property developers maintained worries that the country's delicate macroeconomic backdrop is yet to hit rock bottom.

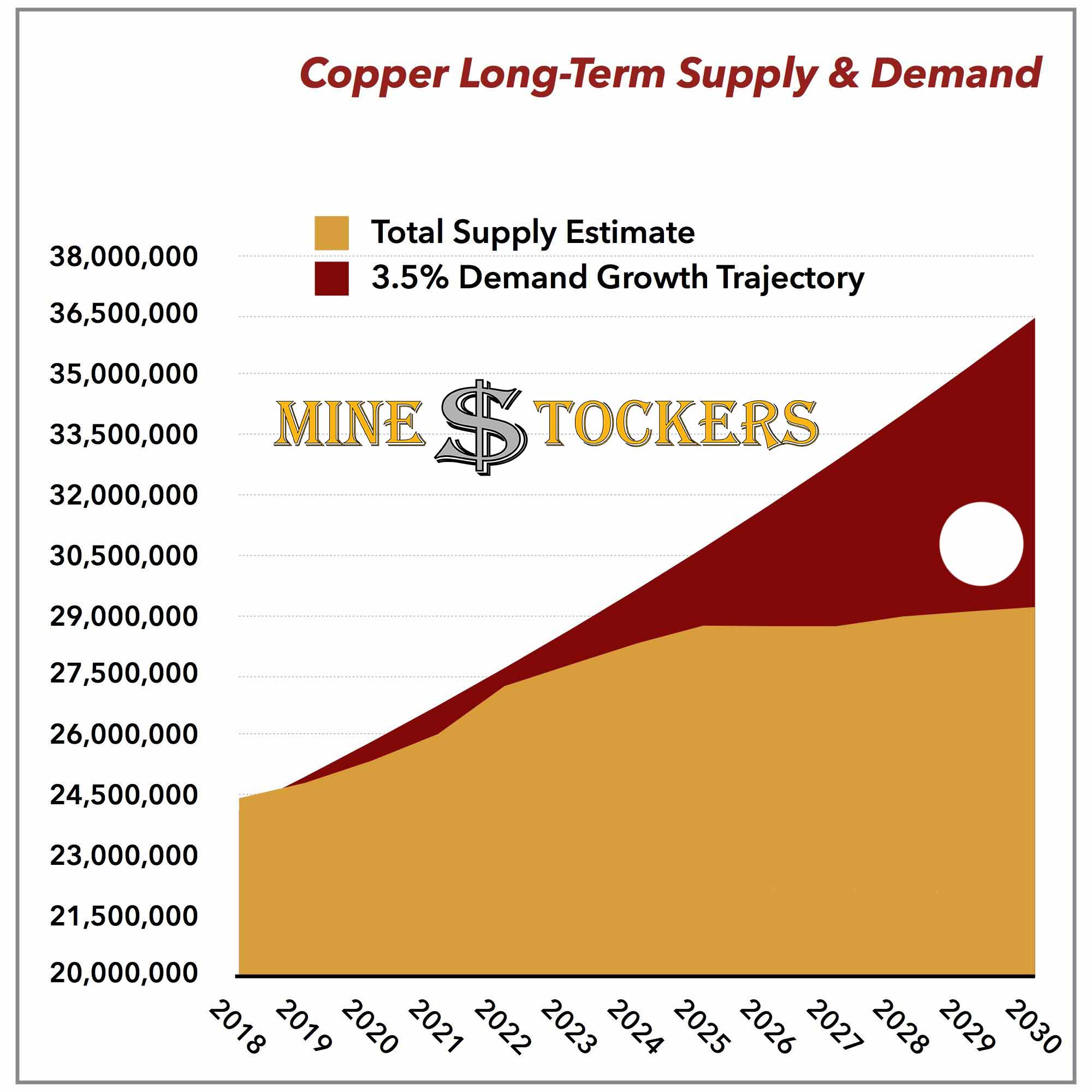

The hawkish perspective of the Federal Reserve and heightening growth apprehensions in Europe have further pressurized industrial activity levels. This is reflected in the continuous months of contractionary manufacturing PMIs. However, futures managed to ward off a further decline, courtesy of the notable observation made by market players regarding large imminent copper deficits. It is becoming evident that the current production levels are failing to keep pace with the increasing demand for electrification.

Production levels dipped significantly, with an exemplar being the 14% output decrease from Chilean state-owned Codelco in just the first half of the year, extending even the 7% decline experienced in 2022. These reductions and heightened demand present a precarious balance worth paying attention to in the coming months.

However, the copper market is not entirely insulated from manipulative practices. The commodities market has ballooned since the 1990s, with more players buying futures, speculating, hedging, and seizing opportunities provided by the complex financial products within the commodities market. An infamous historical instance involved Sumitomo's Mr. Yasuo Hamanaka, a.k.a Mr. Copper, who was at the core of one of the most monumental cases of commodities market manipulation.

Hamanaka used his control over 5% of the global copper supply, forcing the market towards an artificial price and, consequently, fake profits. While the Sumitomo episode provides a historical case of manipulation, it doesn't directly reflect the market's current resilience. The emergence of more players and amplified volatility, combined with new protocols instituted within the London Metal Exchange to stifle market monopolies, make such a long-term manipulation nearly impossible in modern markets. However, there appears to be a more necrotic problem of instant price spikes due to speculators feeding the market's volatility.

In conclusion, while the fluctuation in copper futures and their elaborate manipulation by Mr. Yasuo Hamanaka play a critical role in understanding the complexities underlying the global copper markets, they also call attention to the need for stricter commodities market regulation. Establishing robust protocols that safeguard against both extended and brief manipulation will go a long way in ensuring a healthy global economy and industrial growth.

We like copper, and here are our plays.

Investment Disclosure

The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada