ROAD TOWN, British Virgin Islands, Dec. 08, 2024 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) (“Aura& or the “Company&) is pleased to announce encouraging exploration and drilling results from several high-potential projects in Brazil. These include the Pé Quente Project, located 34 km from the Matupá Project&s X1 Deposit; near-mine expansion at the Paiol Deposit, part of the Almas Mine; and Aura Carajás, all of which are located in Brazil. These results highlight the Company&s ongoing success in advancing its exploration portfolio and reaffirm Aura&s commitment to expanding its resource and reserve base, positioning the Company for sustained growth.

Highlights

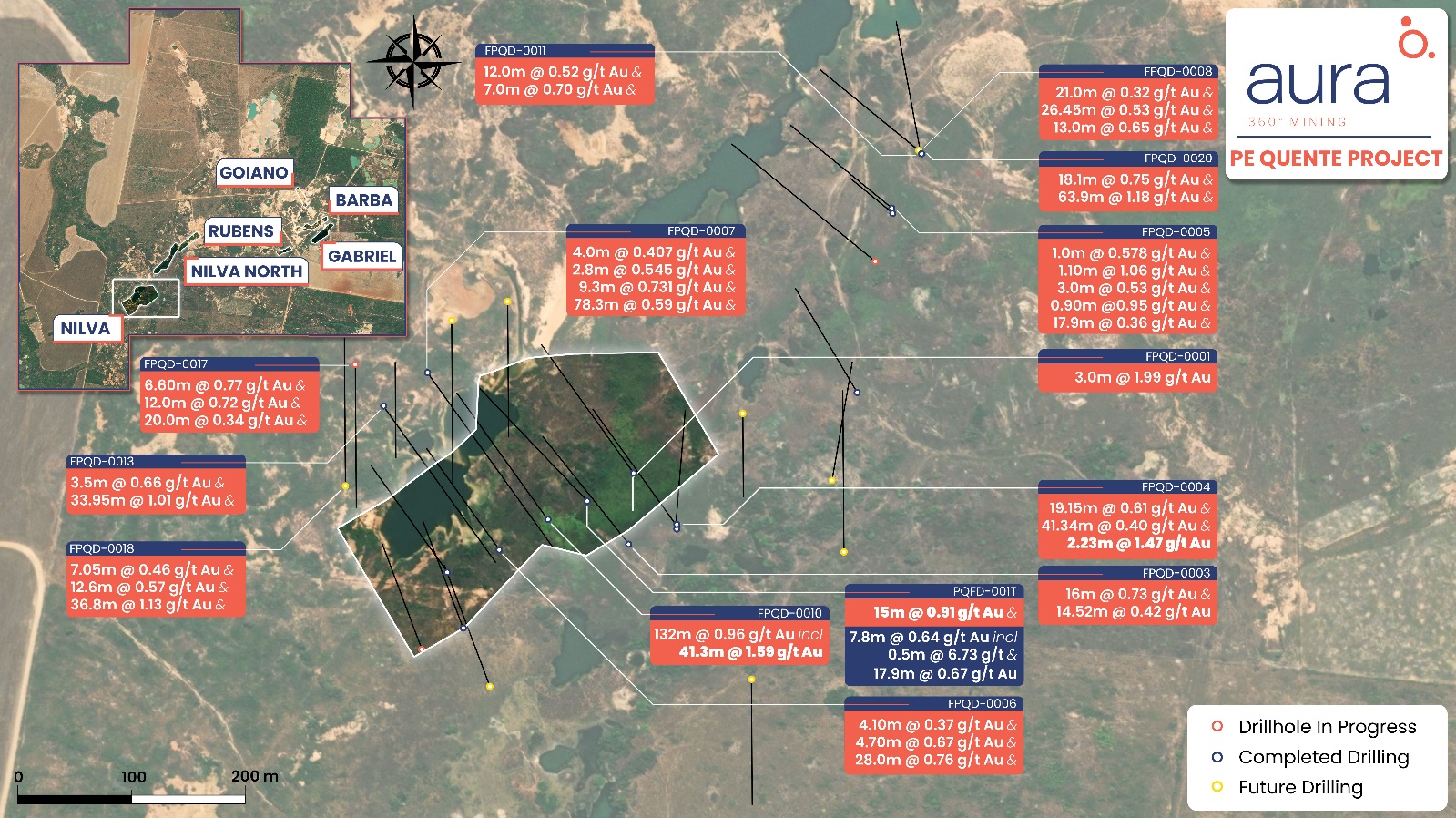

- Pé Quente Project

- The Pé Quente gold deposit is emerging as one of the most significant disseminated gold systems in granitic environments within the Alta Floresta Gold Province, similar to the X1 Deposit and Serrinhas.

- 6,200m of the planned 7,500m program completed with six high-priority targets identified to date.

- Drilling confirmed historical high-grade gold intercepts previously identified by Graben Mineração SA (refer to press release dated May 22, 2024) in the Nilva zone. In addition, drilling also identified a new zone (Nilva North) which expands the footprint of mineralization along strike to the northeast.

- Significant intercepts include:

- Hole FPQD-0010 (Nilva)0.96 g/t Au over 132.00m, including 4.05 g/t Au over 3.00m and 4.00 g/t Au over 2.00m.

- Hole FPQD-0020 (Nilva North): 1.18 g/t Au over 63.90m, including 4.14 g/t Au over 8.00m.

- Pé Quente is one of several promising targets surrounding the X1 Deposit within a 50km radius, where Aura has completed a Feasibility Study.

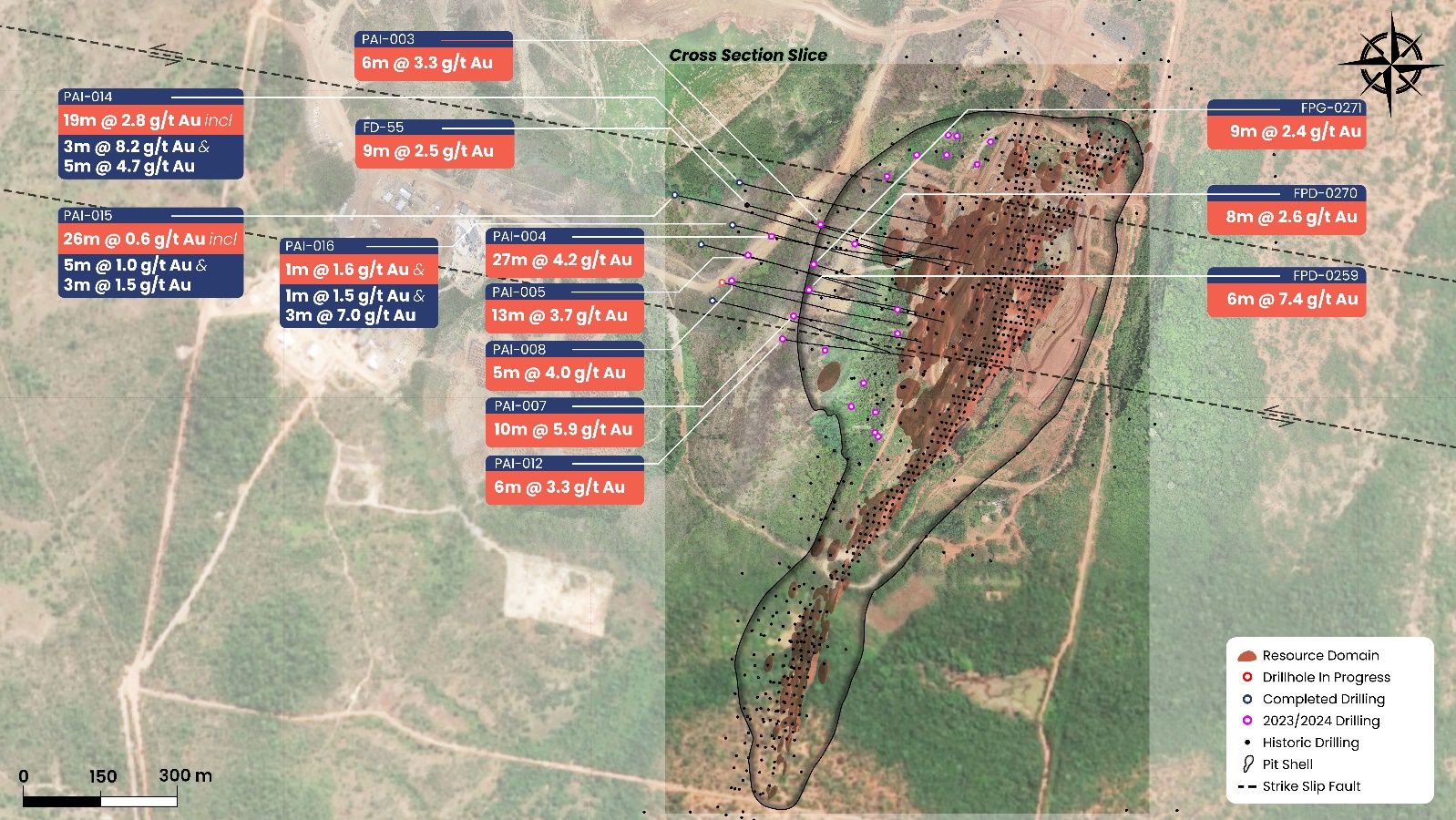

- Paiol Deposit, Almas Mine

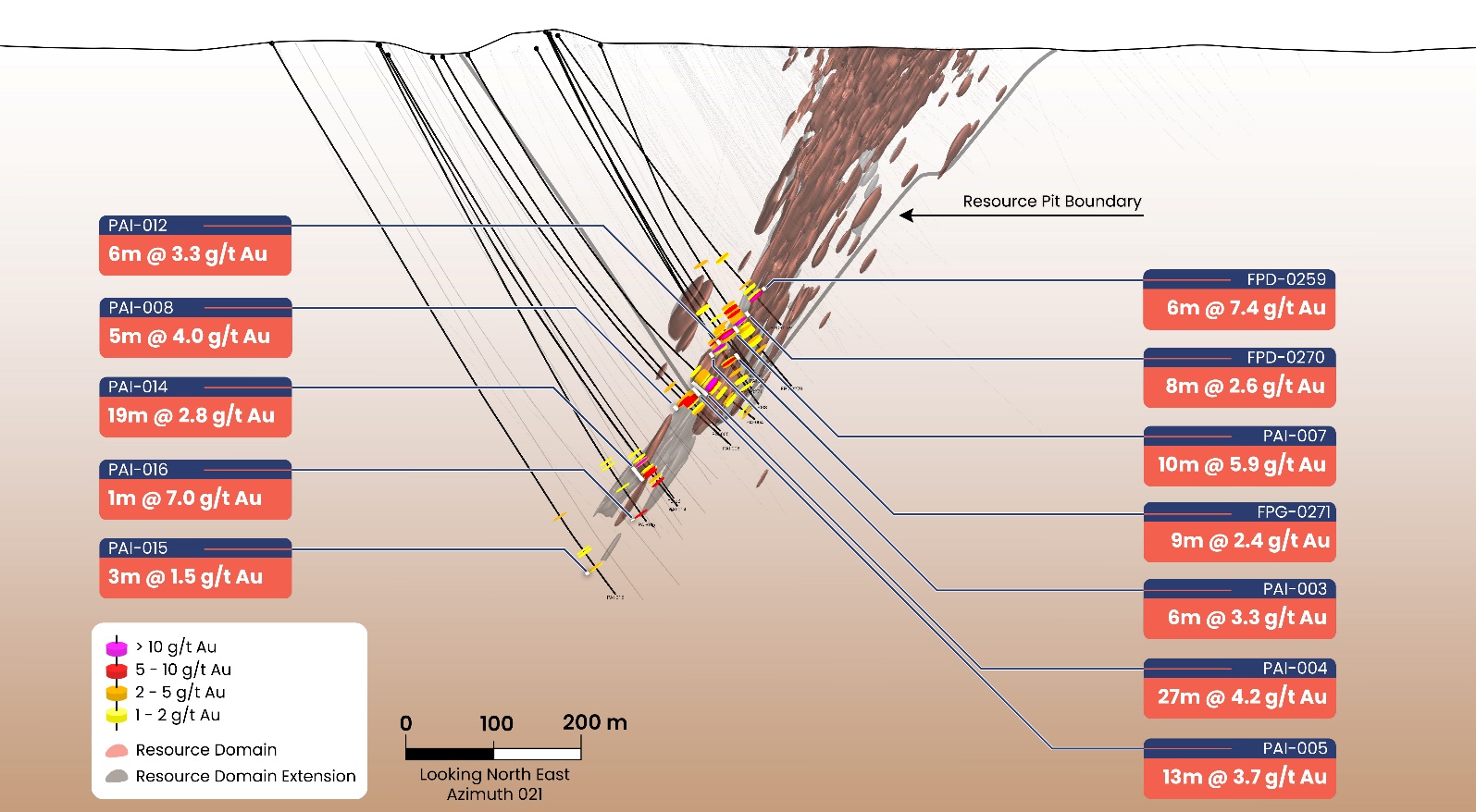

- A 13,000m infill and extension drilling campaign confirmed the high-grade ore body's continuity at depth, supporting potential underground mining and adding ounces to the Inferred Mineral Resources below the current pit. Significant intercepts include:

- Hole PAI-004 1.40 g/t Au over 101.10m, including 4.20 g/t Au over 26.65m, 11.20 g/t Au over 7.00m.

- Hole PAI-005 1.30 g/t Au over 49.05m including, 3.70 g/t Au over 13.05m.

- Hole PAI-014 2.8 g/t Au over 19m including 8.2 g/t Au over 3m and 1.5 g/t Au over 3m.

- Further drilling down dip of the ore body is required to delineate underground potential and open a possibility of having underground and open pit mines at the same time in the Paiol deposit.

- Located in one of the world's most prolific gold-producing environment, that in Brazil hosts over 80 million ounces of gold, offering exceptional potential for extending Aura's deposits and making new discoveries.

- A 13,000m infill and extension drilling campaign confirmed the high-grade ore body's continuity at depth, supporting potential underground mining and adding ounces to the Inferred Mineral Resources below the current pit. Significant intercepts include:

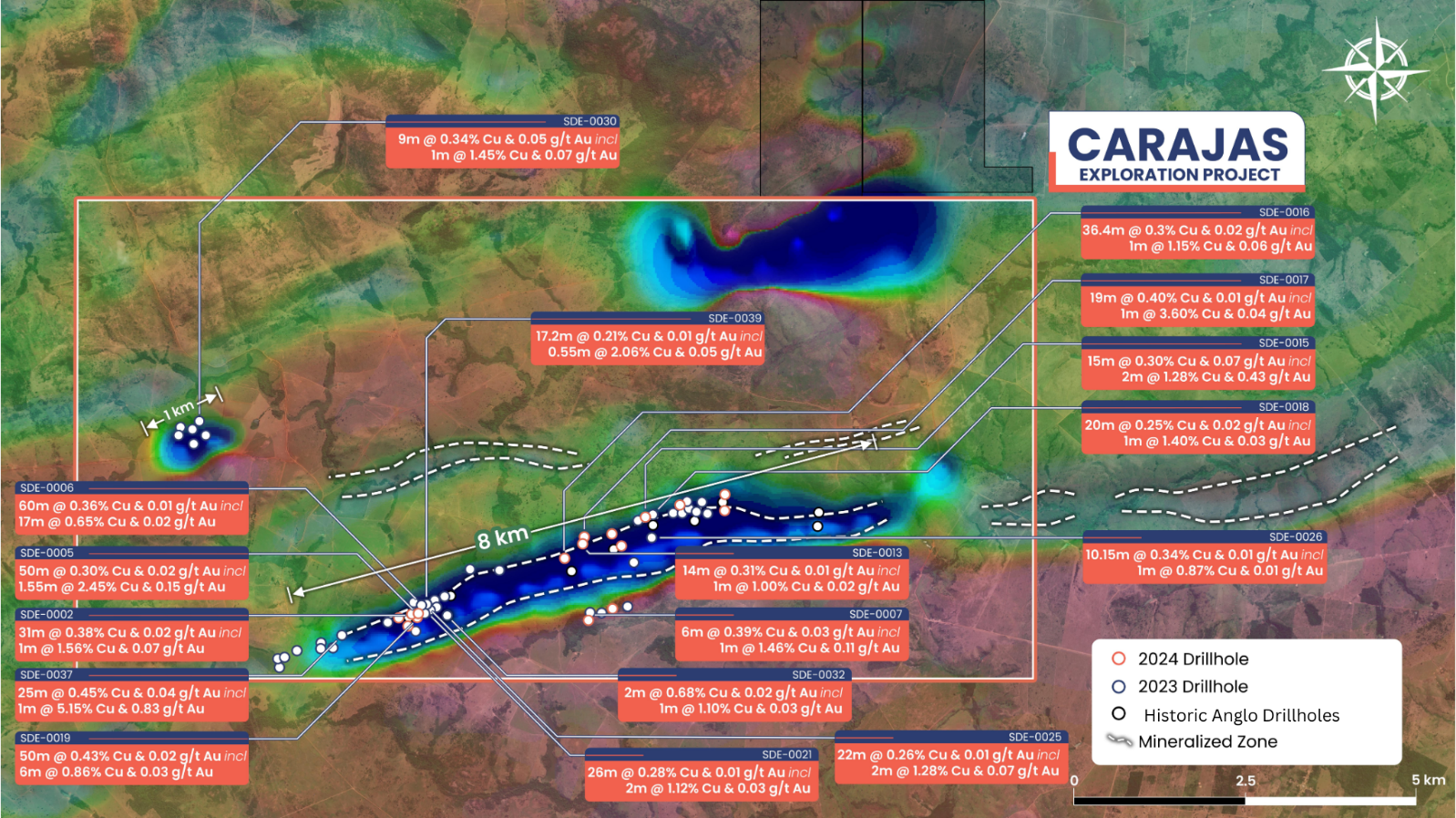

- Aura Carajás

- A 22,000m inaugural drilling campaign between 2023 and 2024 confirmed multiple zones of mineralization extending the strike to 8 kilometers between a southern and northwestern trend, which provides an excellent opportunity of different styles of IOCG mineralization to be explored.

- Drilling has delineated semi-massive sulfide zones with higher grades (exceeding 1% Cu) within low (<0.5% Cu) and medium-grade (0.5% to 1% Cu) disseminated mineralized envelopes, with semi-massive and medium-grade zones primarily identified in the southwest zone where drilling density is higher. Significant intercepts include:

- Hole SDE-0053 0.95% Cu over 11.00m, including 1.23% Cu over 7.00m

- Ongoing drilling aims to expand the high-grade semi-massive zones and the mineralized footprint along strike to generate a sizeable maiden mineral resource estimate.

- The Southern Carajás Copper Belt hosts some of the largest IOCG deposits in the region, encompassing over five major copper projects with a combined total of approximately 1.5Bt of copper ore, grading between 0.5% and 3% Cu.

Rodrigo Barbosa, President and CEO of Aura, commented, “During the last 4 years, we have doubled our Reserves and Resources at an average cost of US$25/Oz, which is 80% below the global average. At Almas, the results of 2.8 g/t Au over 19m and 3.70 g/t Au over 13.05m illustrate the potential for expanding into a high-grade underground mine at Paiol Mine. The potential combination of an open pit and underground mining in the future will result in an average grade increase and production increase.

Similarly, the 0.96 g/t Au over 132.00m at Pé Quente is promising, suggesting it could become a mine alongside X1, increasing Matupá's Resources and Reserves in the near future. This could also be combined with potential resources from Serrinhas large-scale IOCG deposits in the region. The higher grades encountered in drilling so far bolster confidence in the project's future value, which we plan to further explore through continued drill testing.

Today's results once again underscore the success of our exploration strategy. The scale and grades we are uncovering across all three projects highlight the transformative potential of these initiatives, strengthening our capacity to achieve substantial reserve and resource growth in the coming years while maintaining a balanced exposure to both gold and copper.&

Pé Quente Project

The Pé Quente Gold Project, located 34 km from the X1 Deposit at Aura&s Matupá Project in Mato Grosso, Brazil, offers a significant opportunity to expand resources in the Alta Floresta Gold Province. Spanning 19,593 hectares, the project features gold mineralization linked to intrusion-related deposits controlled by regional structural trends.

Acquired in May 2024, Pé Quente has a historical in situ resource estimate of 257Koz (6.26 million tonnes @ 1.28 g/t Au) (See Aura&s press release dated May 22, 2024) based on prior exploration, including 97 drill holes (11,782m). Aura&s ongoing 7,500-meter drilling program confirmed and extended known mineralization, strengthening the Company&s strategic decision to delay Matupá&s construction to optimize the region&s potential. Future drill holes will aim to extend mineralization further with up to 200m step outs (Figure 2).

Figure 1: Location of Matupa Project

Figure 2: Nilva and Nilva North Initial Drilling Results Showing High-Grade Intercepts

Table 1: Summary of Drill Results from Nilva and Nilva North Targets at the Pé Quente Project

| Hole | From (m) | To (m) | Interval (m) | Au (g/t) |

| PQFD-001T | 32.15 | 47.45 | 15.30 | 0.91 |

| Incl. | 54.20 | 62.00 | 7.80 | 0.64 |

| And | 128.30 | 146.20 | 17.90 | 0.67 |

| FPQD-0001 | 49.00 | 52.00 | 3.00 | 1.99 |

| FPQD-0003 | 100.00 | 116.00 | 16.00 | 0.73 |

| Incl. | 121.83 | 136.85 | 14.52 | 0.42 |

| FPQD-0004 | 60.85 | 80.00 | 19.15 | 0.61 |

| Incl. | 88.46 | 129.80 | 41.34 | 0.40 |

| Incl. | 142.00 | 144.23 | 2.23 | 1.47 |

| FPQD-0005 | 11.00 | 12.00 | 1.00 | 0.58 |

| And | 108.90 | 110.00 | 1.10 | 1.06 |

| Incl. | 118.00 | 121.00 | 3.00 | 0.53 |

| Incl. | 122.80 | 123.70 | 0.90 | 0.95 |

| Incl. | 124.40 | 142.30 | 17.90 | 0.39 |

| FPQD-0006 | 66.70 | 70.00 | 4.10 | 0.37 |

| Incl. | 108.30 | 113.00 | 4.70 | 0.67 |

| And | 143.00 | 175.00 | 28.00 | 0.76 |

| FPQD-0007 | 1.00 | 5.00 | 4.00 | 0.41 |

| Incl. | 54.20 | 57.00 | 2.80 | 0.55 |

| And | 72.70 | 82.00 | 9.30 | 0.73 |

| Incl. | 129.70 | 208.00 | 78.30 | 0.59 |

| FPQD-0008 | 65.00 | 93.00 | 21.00 | 0.32 |

| Incl. | 99.55 | 126.00 | 26.45 | 0.53 |

| And | 137.00 | 150.00 | 13.00 | 0.65 |

| FPQD-0010 | 85.00 | 217.00 | 132.00 | 0.96 |

| FPQD-0011 | 99.00 | 111.00 | 12.00 | 0.52 |

| And | 117.00 | 124.00 | 7.00 | 0.70 |

| FPQD-0017 | 55.40 | 62.00 | 6.60 | 0.77 |

| Incl. | 80.00 | 92.00 | 12.00 | 0.72 |

| Incl. | 100.00 | 120.00 | 20.00 | 0.34 |

| FPQD-0018 | 50.75 | 57.80 | 7.05 | 0.46 |

| Incl. | 129.60 | 144.60 | 12.60 | 0.57 |

| And | 170.60 | 207.40 | 36.80 | 1.13 |

| FPQD-0020 | 57.00 | 74.00 | 18.10 | 0.75 |

| And | 94.10 | 158.00 | 63.90 | 1.18 |

| PQFD-0013T | 139.00 | 185.70 | 46.70 | 0.85 |

| Incl. | 34.90 | 38.40 | 3.50 | 0.66 |

| And | 181.20 | 215.15 | 33.95 | 1.01 |

Paiol Deposit, Almas Mine

Almas – an open pit gold operation located in the state of Tocantins, Brazil, and is wholly-owned by Aura, that consists of three deposits (Paiol, Vira Saia and Cata Funda) and several exploration targets. The Paiol Mine, located in the northernmost part of the Brasília Gold Belt, is hosted within the Riachão do Ouro Greenstone, consisting of ocean-floor volcanic rocks altered by metamorphism, deformation, and hydrothermal activity during the Paleoproterozoic collisional event. This event facilitated the migration of gold-bearing fluids, leading to mineralization.

A total of 34 diamond drill holes, covering 12,989.50 meters, were completed to convert Inferred Mineral Resources to Indicated Mineral Resources. Drilling intersected hydrothermally altered metabasalt characterized by silicification and sulfidation (Py+Po+Aspy), consistent with the modeled ore body. These results, primarily in the central portion of the Paiol Mine, suggest continuity of high-grade mineralization at depth, highlighting the potential for developing an underground mining operation. A summary of the results is provided in Table 2.

Table 2: Summary of Drill Results from the Paiol Deposit

| Hole | From (m) | To (m) | Interval (m) | Au (g/t) |

| PAI-001

|

259.75 | 306.00 | 46.25 | 0.6 |

| 289.00 | 293.00 | 4.00 | 3.40 | |

| 325.55 | 329.35 | 3.80 | 3.20 | |

| PAI-002

|

126.25 | 148.25 | 22.00 | 0.36 |

| 140.25 | 142.25 | 2.00 | 1.00 | |

| 222.85 | 225.85 | 3.00 | 0.48 | |

| 245.40 | 249.40 | 4.00 | 0.41 | |

| 258.40 | 290.75 | 32.35 | 0.30 | |

| 285.05 | 288.05 | 3.00 | 1.00 | |

| 323.00 | 324.00 | 1.00 | 1.30 | |

| 335.00 | 336.00 | 1.00 | 1.60 | |

| 126.25 | 148.25 | 22.00 | 0.36 | |

| 140.25 | 142.25 | 2.00 | 1.00 | |

| 222.85 | 225.85 | 3.00 | 0.48 | |

| PAI-003

|

339.15 | 340.15 | 1.00 | 0.56 |

| 359.15 | 360.15 | 1.00 | 0.83 | |

| 402.85 | 459.55 | 56.70 | 1.00 | |

| 419.60 | 427.60 | 8.00 | 2.60 | |

| PAI-004

|

429.20 | 530.30 | 101.10 | 1.40 |

| 456.55 | 483.20 | 26.65 | 4.20 | |

| 472.20 | 479.20 | 7.00 | 11.20 | |

| PAI-005

|

470.20 | 519.25 | 49.05 | 1.30 |

| 480.90 | 493.95 | 13.05 | 3.70 | |

| PAI-006

|

349.00 | 429.90 | 80.90 | 0.50 |

| 405.60 | 428.60 | 23.00 | 1.20 | |

| 421.60 | 425.60 | 4.00 | 3.40 | |

| PAI-007

|

370.90 | 407.00 | 36.10 | 2.00 |

| 395.90 | 406.00 | 10.10 | 5.90 | |

| PAI-008

|

466.50 | 508.50 | 42.00 | 0.80 |

| 488.50 | 493.50 | 5.00 | 4.00 | |

| PAI-009

|

151.65 | 187.25 | 35.60 | 0.30 |

| 184.25 | 185.25 | 1.00 | 1.20 | |

| 276.60 | 288.00 | 11.40 | 0.23 | |

| 371.45 | 372.45 | 1.00 | 0.60 | |

| PAI-010

|

204.50 | 224.50 | 20.00 | 0,4 |

| 220.50 | 222.50 | 2.00 | 1.20 | |

| 305.50 | 308.50 | 3.00 | 0.50 | |

| 327.60 | 349.40 | 21.80 | 0.80 | |

| 335.60 | 346.60 | 11.00 | 1.30 | |

| 363.15 | 370.15 | 7.00 | 0.50 | |

| 393.20 | 396.20 | 3.00 | 0.90 | |

| PAI-011

|

330.50 | 332.50 | 2.00 | 0.50 |

| 351.50 | 394.50 | 43.00 | 0.50 | |

| 363.50 | 365.50 | 2.00 | 2.60 | |

| PAI-012

|

380.15 | 414.95 | 34.80 | 1.00 |

| 403.15 | 409.95 | 6.80 | 3.30 | |

| PAI-013

|

225.70 | 257.45 | 31.75 | 0.90 |

| 245.30 | 250.30 | 5.00 | 2.10 | |

| PAI-014

|

562.25 | 606.20 | 43.95 | 1.60 |

| 574.20 | 593.20 | 19.00 | 2.80 | |

| 574.20 | 577.05 | 2.85 | 8.20 | |

| 588.15 | 593.20 | 5.05 | 4.70 | |

| PAI-015

|

632.75 | 633.75 | 1.00 | 4.40 |

| 679.60 | 705.90 | 26.30 | 0.58 | |

| 679.60 | 684.60 | 5.00 | 1.00 | |

| 702.90 | 705.90 | 3.00 | 1.50 | |

| PAI-016

|

542.70 | 549.70 | 7.00 | 0.60 |

| 542.70 | 543.70 | 1.00 | 1.40 | |

| 548.70 | 549.70 | 1.00 | 1.60 | |

| 577.75 | 578.65 | 0.90 | 1.50 | |

| 615.25 | 616.25 | 1.00 | 7.00 | |

| PAI-017

|

577.50 | 600.60 | 23.10 | 0.45 |

| 577.50 | 578.50 | 1.00 | 1.60 | |

| 580.50 | 581.50 | 1.00 | 1.30 | |

| 591.45 | 592.45 | 1.00 | 1.90 | |

| 597.60 | 598.60 | 1.00 | 1.00 | |

| 599.60 | 600.60 | 1.00 | 1.70 | |

| PAI-018

|

526.50 | 543.00 | 16.50 | 0.48 |

| 528.50 | 529.50 | 1.00 | 1.30 | |

| 542.00 | 543.00 | 1.00 | 1.40 | |

| PAI-019

|

527.80 | 539.05 | 11.25 | 1.00 |

| 527.80 | 530.80 | 3.00 | 1.50 | |

| 533.80 | 535.05 | 1.25 | 1.70 | |

| 536.05 | 537.05 | 1.00 | 1.00 | |

| 538.05 | 539.05 | 1.00 | 1.90 |

Figure 3: Cross section slice of the Paiol Deposit, part of the Almas Mine showing recent drilling extending mineralization up to 300m from the existing pit.

Figure 4: Paiol Deposit Cross Section Showing Resource Pit Boundary and High-Grade Intercepts at Depth

Aura Carajás

The Aura Carajás Project is a permitted exploration target of 9,805 hectares, located in the State of Para, Brazil, Carajás area. The area includes iron oxide copper gold (“IOCG&) mineralization targets along a 6 km strike with copper surface anomalies of up to 500ppm Cu and has nine historical exploration holes totaling 2,552 meters with positive intercepts showing mineralization.

In 2023 and 2024, Aura Minerals completed approximately 22,000 meters of diamond drilling (DDH) across 65 holes, confirming and extending the strike to 7 kilometers. The primary mineralized zone, known as Trend S (encompassing both West and East portions), extends approximately 5 kilometers along a NE-SW strike. During the 2024 exploration campaign, two additional zones were identified: Trend N (a regional target) and Trend SW, contributing approximately 2 kilometers of newly identified anomalies, further expanding the project's potential (Figure 5).

Preliminary results indicate low- to medium-grade copper zones (>0.2% Cu to <0.5% Cu) extending approximately 50 meters in thickness, primarily associated with disseminated sulfides within hydrothermally altered rock matrices. Within these broader zones, higher-grade copper zones (>0.5% Cu) have been identified, typically ranging from 15 to 20 meters in thickness, characterized by vein-hosted mineralization. Additionally, semi-massive sulfide zones with high-grade copper (>1% Cu) have been observed, averaging approximately 5 meters in width (not true width).

Figure 5: Multiple zones of mineralization

Table 3: Significant Drill Results from Aura Carajas

| Hole | From (m) | To (m) | Interval (m) | Cu (%) | Au (g/t) | Target Area |

| SDE-0002 | 188.00 | 219.00 | 31.00 | 0.38 | 0.02 | Trend S – West Zone

|

| Inc. | 188.00 | 189.00 | 1.00 | 1.34 | 0.06 | |

| Inc. | 201.00 | 202.00 | 1.00 | 1.56 | 0.07 | |

| Inc. | 212.00 | 213.00 | 1.00 | 1.39 | 0.09 | |

| And | 301.00 | 331.00 | 30.00 | 0.21 | - | |

| SDE-0003 | 2.00 | 31.50 | 29.50 | 0.37 | 0.04 | Trend S – West Zone

|

| Inc. | 6.00 | 9.00 | 3.00 | 0.82 | 0.30 | |

| Inc. | 6.00 | 7.00 | 1.00 | 0.81 | 0.72 | |

| And | 31.50 | 52.00 | 20.50 | 0.30 | 0.01 | |

| And | 97.00 | 103.00 | 6.00 | 0.42 | 0.00 | |

| SDE-0005 | 55.00 | 56.00 | 1.00 | 0.47 | - | Trend S – West Zone

|

| And | 94.00 | 95.20 | 1.20 | 1.00 | - | |

| And | 144.00 | 145.00 | 1.00 | 0.68 | - | |

| And | 151.00 | 152.00 | 1.00 | 0.46 | - | |

| And | 161.00 | 164.00 | 3.00 | 0.43 | - | |

| And | 173.00 | 176.00 | 3.00 | 0.24 | - | |

| And | 192.00 | 242.00 | 50.00 | 0.30 | 0.02 | |

| Inc. | 192.00 | 199.00 | 7.00 | 0.75 | 0.04 | |

| Inc. | 194.45 | 196.00 | 1.55 | 2.45 | 0.15 | |

| SDE-0006 | 189.00 | 249.00 | 60.00 | 0.36 | 0.01 | Trend S – West Zone

|

| Inc. | 198.00 | 236.00 | 38.00 | 0.47 | 0.02 | |

| Inc. | 198.00 | 215.00 | 17.00 | 0.65 | 0.02 | |

| Inc. | 201.00 | 207.00 | 6.00 | 0.96 | 0.00 | |

| Inc. | 201.00 | 202.00 | 1.00 | 2.53 | 0.04 | |

| Inc. | 206.00 | 207.00 | 1.00 | 1.24 | 0.03 | |

| Inc. | 211.00 | 212.00 | 1.00 | 1.04 | 0.05 | |

| SDE-0007 | 143.00 | 149.00 | 6.00 | 0.39 | 0.03 | Trend PGE

|

| Inc. | 148.00 | 149.00 | 1.00 | 1.46 | 0.11 | |

| SDE-0011 | 165.00 | 181.00 | 16.00 | 0.22 | 0.01 | Trend S – East Zone

|

| And | 196.00 | 214.00 | 18.00 | 0.29 | 0.02 | |

| Inc. | 208.00 | 213.20 | 5.20 | 0.50 | 0.03 | |

| SDE-0012 | 149.00 | 161.00 | 12.00 | 0.20 | 0.01 | Trend S – East Zone |

| SDE-0013 | 127.00 | 141.00 | 14.00 | 0.31 | 0.01 | Trend S – East Zone

|

| Inc. | 127.00 | 128.00 | 1.00 | 0.94 | 0.04 | |

| Inc. | 134.00 | 135.00 | 1.00 | 1.00 | 0.02 | |

| And | 225.00 | 244.00 | 19.00 | 0.26 | 0.04 | |

| Inc. | 235.00 | 236.00 | 1.00 | 0.80 | 0.21 | |

| SDE-0015 | 106.00 | 114.00 | 8.00 | 0.30 | 0.02 | Trend S – East Zone

|

| Inc. | 110.00 | 111.00 | 1.00 | 0.83 | 0.07 | |

| Inc. | 135.00 | 150.00 | 15.00 | 0.31 | 0.07 | |

| And | 138.00 | 140.00 | 2.00 | 1.28 | 0.43 | |

| SDE-0016 | 132.60 | 169.00 | 36.40 | 0.31 | 0.02 | Trend S – East Zone

|

| Inc. | 137.00 | 139.00 | 2.00 | 1.15 | 0.06 | |

| Inc. | 162.00 | 163.00 | 1.00 | 0.83 | 0.03 | |

| And | 317.00 | 318.00 | 1.00 | 0.03 | 0.54 | |

| SDE-0017 | 313.00 | 332.00 | 19.00 | 0.40 | 0.01 | Trend S – East Zone

|

| Inc. | 316.00 | 317.00 | 1.00 | 3.60 | 0.04 | |

| SDE-0018 | 215.00 | 235.00 | 20.00 | 0.25 | 0.02 | Trend S – East Zone

|

| Inc. | 221.00 | 222.00 | 1.00 | 1.40 | 0.03 | |

| SDE-0019 | 5.00 | 28.25 | 23.25 | 0.44 | 0.01 | Trend S – West Zone

|

| Inc. | 25.00 | 26.00 | 1.00 | 1.53 | 0.06 | |

| And | 28.25 | 55.00 | 26.75 | 0.43 | 0.02 | |

| Inc. | 50.00 | 51.00 | 1.00 | 1.12 | 0.10 | |

| SDE-0020 | 254.00 | 255.00 | 1.00 | 0.89 | 0.00 | Trend N

|

| And | 326.90 | 327.40 | 0.50 | 3.37 | 0.09 | |

| SDE-0021 | 136.00 | 162.00 | 26.00 | 0.28 | 0.01 | Trend S – West Zone

|

| Inc. | 157.00 | 162.00 | 5.00 | 0.67 | 0.02 | |

| Inc. | 159.00 | 161.00 | 2.00 | 1.12 | 0.03 | |

| Inc. | 160.00 | 161.00 | 1.00 | 1.68 | 0.05 | |

| SDE-0025 | 82.00 | 104.00 | 22.00 | 0.26 | 0.01 | Trend S – West Zone

|

| Inc. | 82.00 | 86.00 | 4.00 | 0.75 | 0.04 | |

| Inc. | 82.00 | 84.00 | 2.00 | 1.28 | 0.07 | |

| And | 236.00 | 259.00 | 23.00 | 0.27 | 0.02 | |

| Inc. | 236.00 | 238.00 | 2.00 | 0.65 | 0.02 | |

| And | 248.00 | 259.00 | 11.00 | 0.33 | 0.03 | |

| Inc. | 253.00 | 256.00 | 3.00 | 0.57 | 0.04 | |

| Inc. | 255.00 | 256.00 | 1.00 | 1.00 | 0.08 | |

| SDE-0026 | 44.00 | 47.00 | 3.00 | 0.34 | 0.02 | Trend S – East Zone

|

| And | 291.00 | 293.00 | 2.00 | 0.44 | 0.02 | |

| And | 376.00 | 386.15 | 10.15 | 0.34 | 0.01 | |

| SDE-0030 | 388.00 | 397.00 | 9.00 | 0.34 | 0.05 | Trend N

|

| And | 410.00 | 413.00 | 3.00 | 0.63 | 0.05 | |

| Inc. | 410.00 | 411.00 | 1.00 | 1.45 | 0.07 | |

| And | 421.00 | 423.00 | 2.00 | 0.72 | 0.03 | |

| Inc. | 422.00 | 423.00 | 1.00 | 1.10 | 0.03 | |

| And | 458.00 | 464.00 | 6.00 | 0.22 | 0.03 | |

| And | 478.00 | 482.45 | 4.45 | 0.21 | 0.03 | |

| SDE-0032 | 262.00 | 264.00 | 2.00 | 0.68 | 0.02 | Trend S – West Zone

|

| Inc. | 262.00 | 263.00 | 1.00 | 1.10 | 0.03 | |

| And | 289.00 | 294.00 | 5.00 | 0.21 | 0.00 | |

| And | 306.00 | 309.00 | 3.00 | 0.25 | 0.01 | |

| And | 385.00 | 388.00 | 3.00 | 0.33 | 0.02 | |

| SDE-0035 | 99.00 | 114.00 | 15.00 | 0.30 | 0.02 | Trend S – West Zone

|

| And | 268.60 | 270.60 | 2.00 | 0.55 | 0.03 | |

| SDE-0037 | 240.00 | 247.00 | 7.00 | 0.30 | 0.02 | Trend SW

|

| And | 321.00 | 322.00 | 1.00 | 5.15 | 0.83 | |

| And | 352.10 | 359.50 | 7.40 | 0.31 | 0.02 | |

| And | 403.00 | 428.00 | 25.00 | 0.45 | 0.04 | |

| Inc. | 403.00 | 412.00 | 9.00 | 0.92 | 0.08 | |

| Inc. | 404.00 | 410.00 | 6.00 | 1.17 | 0.10 | |

| Inc. | 404.00 | 406.00 | 2.00 | 2.11 | 0.17 | |

| Inc. | 409.00 | 410.00 | 1.00 | 1.97 | 0.17 | |

| SDE-0039 | 100.00 | 104.60 | 4.60 | 0.46 | 0.01 | Trend S – West Zone

|

| And | 202.00 | 219.20 | 17.20 | 0.21 | 0.01 | |

| Inc. | 202.00 | 208.80 | 6.80 | 0.31 | 0.02 | |

| Inc. | 218.65 | 219.20 | 0.55 | 2.06 | 0.05 | |

| SDE-0045 | 72.00 | 73.00 | 1.00 | 0.86 | 0.04 | Trend S – East Zone

|

| 101.00 | 116.00 | 15.00 | 0.18 | 0.00 | ||

| Inc. | 101.00 | 103.00 | 2.00 | 0.31 | 0.01 | |

| Inc. | 109.00 | 116.00 | 7.00 | 0.20 | 0.01 | |

| 135.00 | 136.00 | 1.00 | 0.20 | 0.01 | ||

| 143.00 | 145.00 | 2.00 | 0.21 | 0.01 | ||

| SDE-0047 | 144.00 | 146.00 | 2.00 | 0.23 | 0.01 | Trend S – East Zone

|

| 185.00 | 192.00 | 7.00 | 0.20 | 0.01 | ||

| 201.00 | 207.00 | 6.00 | 0.35 | 0.02 | ||

| Inc. | 206.00 | 207.00 | 1.00 | 0.80 | 0.04 | |

| SDE-0050 | 88.50 | 94.45 | 5.95 | 0.22 | 0.02 | Trend S – West Zone

|

| 117.00 | 118.00 | 1.00 | 0.27 | 0.02 | ||

| SDE-0052 | 89.00 | 91.00 | 2.00 | 0.32 | 0.02 | Trend SW

|

| 98.00 | 102.00 | 4.00 | 0.95 | 0.05 | ||

| 99.00 | 100.00 | 1.00 | 2.45 | 0.12 | ||

| 116.00 | 121.00 | 5.00 | 0.26 | 0.02 | ||

| 148.00 | 151.00 | 3.00 | 0.47 | 0.03 | ||

| SDE-0053 | 180.00 | 191.00 | 11.00 | 0.95 | 0.06 | Trend S – West Zone

|

| Inc. | 181.00 | 188.00 | 7.00 | 1.23 | 0.08 | |

| Inc. | 181.00 | 183.00 | 2.00 | 1.70 | 0.06 | |

| Inc. | 185.00 | 188.00 | 3.00 | 1.46 | 0.13 | |

| Inc. | 187.00 | 188.00 | 1.00 | 2.20 | 0.27 |

*Remaining holes contained mineralization below 0.02% Cu cut-off. These include SDE-008, 009, 010, 014, 0046

Quality Assurance and Quality Control

Almas QAQC Measures

Almas Gold Project QA/QC program requires that the following minimum number of control samples be inserted into the drilling samples being submitted to the laboratory: One high ore-grade and one low ore-grade CRM (or medium grade) in each analytical batch of 40 samples (5%) and a minimum of two blanks inserted in each batch mainly after mineralized zones. The control sample assay results of the internal QA/QC program were monitored, including the CRMs, pulp duplicates and sizing checks during preparation. Additionally, systematic checks of the digital database were conducted against the original signed Certificates of Analysis from the laboratory.

Aura Carajas QAQC Measures

Drill core was sawed in the Project core shed and shipped to ALS, in Parauapebas, Pará-Brazil, where the samples were crushed, pulverized and homogenized, then pulp samples were sent to ALS Laboratory, in Lima-Peru, to conduct the analytical works, and analyze them for Gold using Fire Assay (Atomic Absorption – fusion 50 g aliquots) and ME-ICP61 analysis for determination of up to 34 elements by ICP/Digestion with aqua regia. For samples with Copper grades higher than 10,000 ppm, the analysis ME-OG62 was applied. The remaining coarse and pulverized rejection of the samples were returned to the Project facility for storage.

Serra da Estrela (Aura Carajas) had routine quality control procedures which ensured that every batch included five percent of commercial standard (high, medium or low grade), and five percent of blank sample. ALS laboratory has its own routine quality control procedures which ensured the insertion of blanks, commercial standards and duplicates into each batch of samples to be analyzed. All analytical results and certificates from both laboratories were provided separately and digital copies of the files were stored in the digital database.

Pé Quente QAQC Measures

Quality Assurance and Quality Control Analytical work was carried out by SGS Lab, Geosol Laboratory in Vespasiano, Minas Gerais, Brazil. Drill core samples were crushed, pulverized and homogenized at SGS Geosol laboratory in Goiânia, Goias, Brazil, then pulp samples were shipped to SGS Lab in Vespasiano. All samples were analyzed for gold values determined by fire assay method (code FAA505) with atomic absorption spectrometry finish on 50g aliquots. SGS has routine quality control procedures which ensure that every batch of 20 prepared samples includes one sample repeat, three commercial standards, and blanks. SGS QA/QC measures are independent of Aura. Aura established a standard QA/QC procedure for the drilling programs at Serrinhas by inserting one blank, one standard, and one duplicate for every 40 samples.

For a complete description of Aura&s sample preparation, analytical methods and QA/QC procedures, please refer to 2023 AIF and the applicable Technical Report, a copy of which is available on the Company&s SEDAR profile at www.sedar.com.

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Manager, an employee of Aura and a “qualified person& within the meaning of NI 43-101.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on operating and developing gold and base metal projects in the Americas. The Company has 4 operating mines including the Aranzazu copper-gold-silver mine in Mexico, the Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San Andres) gold mine in Honduras. The Company&s development projects include Borborema and Matupá both in Brazil. Aura has unmatched exploration potential owning over 630,000 hectares of mineral rights and is currently advancing multiple near-mine and regional targets along with the Aura Carajas copper project in the prolific Carajás region of Brazil.

Forward-Looking Information

This press release contains “forward-looking information& and “forward-looking statements&, as defined in applicable securities laws (collectively, “forward-looking statements&) which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as “plans,& “expects,& “is expected,& “budget,& “scheduled,& “estimates,& “forecasts,& “intends,& “anticipates,& or “believes& or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may,& “could,& “would,& “might& or “will& be taken, occur or be achieved. - 2 - Known and unknown risks, uncertainties and other factors, many of which are beyond the Company&s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to the most recent Annual Information Form on file with certain Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, copper and certain other commodities, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements. All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/04cbd06c-04d3-4ba0-b1ea-20f358b7c7b8

https://www.globenewswire.com/NewsRoom/AttachmentNg/d955f84d-05c6-402f-ba04-ec4295f98828

https://www.globenewswire.com/NewsRoom/AttachmentNg/40a4eae1-04a5-4119-8a6f-e2f80717e038

https://www.globenewswire.com/NewsRoom/AttachmentNg/39819dcf-073f-4f57-9347-57cbc820328c

https://www.globenewswire.com/NewsRoom/AttachmentNg/0bbb0bc3-94fe-4764-add6-6822fe0e2163

For further information, please visit Aura&s website at www.auraminerals.com or contact: Investor Relations ri@auraminerals.com www.auraminerals.com