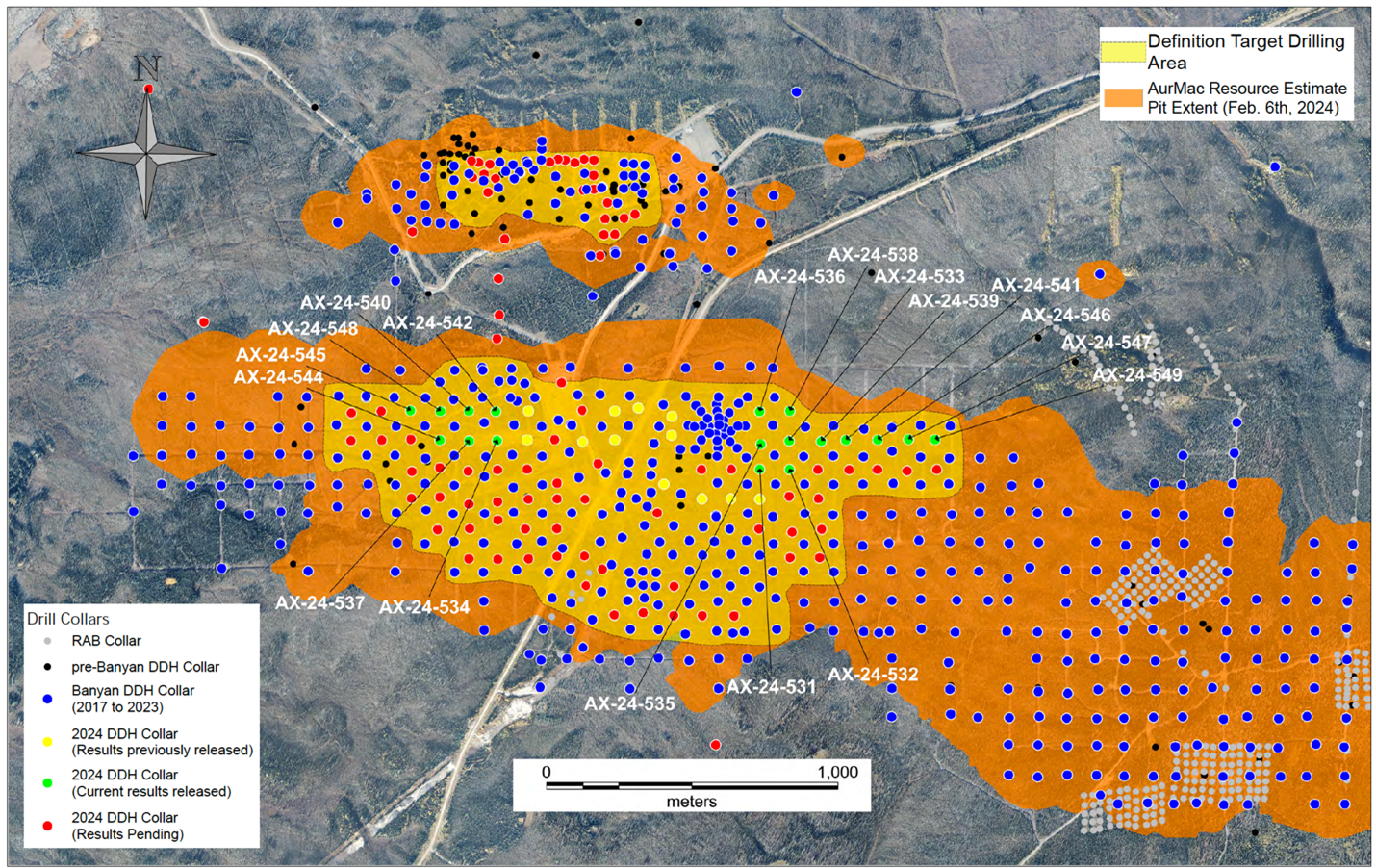

VANCOUVER, BC / ACCESSWIRE / November 4, 2024 / Banyan Gold Corp. (the "Company" or "Banyan") (TSX-V:BYN)(OTCQB:BYAGF) is pleased to announce the latest analytical results from nineteen (19) diamond drillholes within the Powerline Deposit located on the Company's AurMac Project, Yukon Territory ("AurMac"). This set of holes was drilled in the north-central portion of the Powerline Deposit (See Figure 1) as part of the ongoing definition drilling program to increase confidence of the Resource model.

Highlights from these assay results:

-

AX-24-534: 48.0 metres ("m") of 0.53 g/t Au from 75.1 m

-

AX-24-536: 75.1 m of 0.29 g/t Au from near-surface (23.9 m)

-

AX-24-538: 21.5 m of 1.06 g/t Au from near-surface 71.9 m

-

AX-24-540: 0.2 m of 539.30 g/t Au from 166.1 m

-

And 56.7 m of 0.36 g/t Au from 166.3 m

-

-

AX-24-541: 90.0m of 0.68 g/t Au from surface (13.5 m)

-

AX-24-542: 154.1m of 0.58 g/t Au from surface (18.3 m)

-

AX-24-544: 0.3 m of 290.10 g/t Au from 37.1 m

-

AX-24-545: 78.6 m of 0.41 g/t Au from 74.9 m

-

AX-24-548: 79.6 m of 0.56 g/t Au from near-surface (26.5 m)

-

AX-24-549: 37.5 m of 0.81 g/t Au from near-surface (44.5 m)

"The 2024 definition drilling program at AurMac, has intersected multiple instances of high-grade gold veins, exceeding 11.00 g/t Au1and up to 539.00 g/t. These East-West oriented vein sets align with the direction of continuity of the structurally controlled Powerline gold mineralization. The increased drill density realized through this year's work will improve the interpretation of the quantity, distribution and thickness, of these high-grade gold veins and their significance within the framework of the Powerline Gold mineralization, which is in turn expected to result in refinements to the primary structural controls of the deposit," stated Tara Christie, President and CEO. "The successful 2024 AurMac exploration program, combined with record high gold prices, have strategically positioned Banyan for a Resource update, Preliminary Economic Assessment ("PEA"); and, importantly, has provided clear exploration and definition drill targets for 2025."

-

1Banyan considers any assayed interval above the maximum Mineral Resource Estimate ("MRE") capping threshold of 11.00 g/t Au to be High Grade. (News Release: Feb 6, 2024, see About Banyan below)

Highlighted results of drillhole assays from this release are presented in Table 1, collar locations in Table 2 and Figure 1 identifies the drillhole locations.

The Powerline Deposit is contained within a metasedimentary package consisting of predominately schists, quartzites and limestones of the Late Proterozoic to Cambrian Hyland Group. Gold mineralization here is chiefly associated with low angle quartz-sulfosalt-arsenopyrite veins seen crosscutting all lithologies and is interpreted to be associated with a large intrusion related gold system typical of the Tombstone Gold Belt and Selwyn Basin gold deposits.

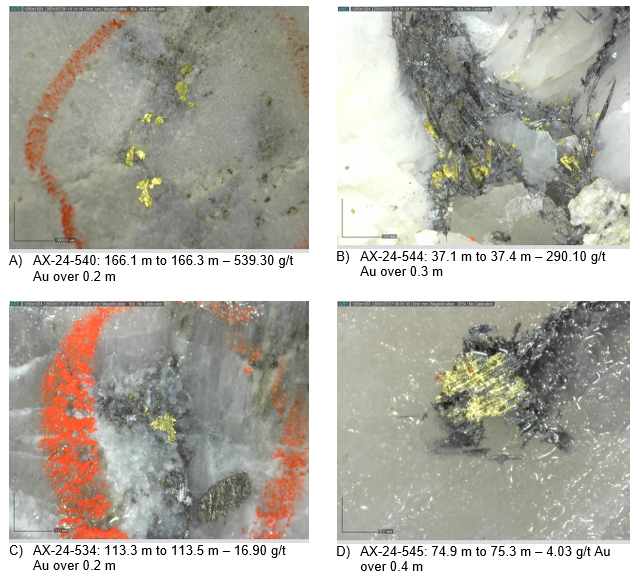

Highlighted instances of visible gold identified from Banyan's detailed logging of these drill holes are shown in Image 1.

Image 1: Photographs of visible gold from holes in this release:

Figure 1:AurMac drill hole locations, showing the location of historic and Banyan completed diamond drill holes used in the MRE (grey, black and blue dots) and collar locations of 2024 drilling (red, green and yellow dots; respectively).

Table 1: Highlighted Powerline Analytical Results.

|

Hole ID |

From (m) |

To (m) |

Interval (m*) |

Au (g/t) |

|---|---|---|---|---|

|

AX-24-531 |

21.5 |

50.5 |

29.0 |

0.49 |

|

and |

94.5 |

158.1 |

63.6 |

0.39 |

|

|

|

|

|

|

|

AX-24-532 |

20.0 |

53.0 |

33.0 |

0.44 |

|

and |

94.5 |

112.0 |

17.5 |

0.55 |

|

and |

119.5 |

142.5 |

23.0 |

0.33 |

|

|

|

|

|

|

|

AX-24-533 |

13.3 |

100.0 |

86.7 |

0.40 |

|

|

|

|

|

|

|

AX-24-534 |

55.1 |

62.5 |

7.4 |

0.32 |

|

and |

75.1 |

123.1 |

48.0 |

0.53 |

|

and |

167.9 |

169.2 |

1.3 |

1.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

AX-24-535 |

22.0 |

31.5 |

9.5 |

0.28 |

|

and |

51.5 |

94.0 |

42.5 |

0.37 |

|

and |

103.8 |

115.0 |

11.2 |

0.46 |

|

|

|

|

|

|

|

AX-24-536 |

23.9 |

99.0 |

75.1 |

0.29 |

|

|

|

|

|

|

|

AX-24-537 |

85.1 |

122.5 |

37.4 |

0.33 |

|

and |

155.5 |

170.8 |

15.3 |

0.30 |

|

and |

215.3 |

229.0 |

13.7 |

0.81 |

|

|

|

|

|

|

|

AX-24-538 |

9.1 |

30.6 |

21.4 |

0.60 |

|

and |

71.9 |

93.4 |

21.5 |

1.06 |

|

|

|

|

|

|

|

AX-24-539 |

15.0 |

42.5 |

27.5 |

0.34 |

|

and |

51.0 |

77.5 |

26.5 |

0.26 |

|

and |

89.5 |

112.0 |

22.5 |

0.22 |

|

and |

117.0 |

124.0 |

7.0 |

0.23 |

|

|

|

|

|

|

|

AX-24-540 |

29.0 |

50.3 |

21.3 |

0.31 |

|

and |

69.2 |

98.4 |

29.2 |

0.31 |

|

and |

107.8 |

112.5 |

4.7 |

0.54 |

|

and |

135.6 |

151.4 |

15.8 |

0.45 |

|

and |

159.3 |

182.4 |

23.1 |

5.68 |

|

including |

166.1 |

166.3 |

0.2 |

539.30 |

|

and |

191.9 |

223.0 |

31.1 |

0.32 |

|

|

|

|

|

|

|

AX-24-541 |

13.5 |

103.5 |

90.0 |

0.68 |

|

or |

13.5 |

22.0 |

8.5 |

0.65 |

|

and |

40.0 |

41.5 |

1.5 |

1.23 |

|

and |

56.0 |

75.9 |

19.9 |

0.39 |

|

and |

84.5 |

103.5 |

19.0 |

2.20 |

|

|

|

|

|

|

|

AX-24-542 |

18.3 |

172.4 |

154.1 |

0.58 |

|

or |

18.3 |

39.6 |

21.3 |

1.31 |

|

and |

62.5 |

69.4 |

6.9 |

0.60 |

|

and |

85.3 |

117.9 |

32.6 |

1.23 |

|

and |

144.5 |

172.4 |

27.9 |

0.39 |

|

|

|

|

|

|

|

AX-24-543 |

91.5 |

94.0 |

2.5 |

0.46 |

|

and |

127.3 |

128.0 |

0.7 |

2.62 |

|

and |

163.0 |

166.0 |

3.0 |

0.74 |

|

|

|

|

|

|

|

AX-24-544 |

34.8 |

38.5 |

3.7 |

20.19 |

|

including |

37.1 |

37.4 |

0.3 |

290.10 |

|

and |

77.0 |

86.0 |

9.0 |

0.67 |

|

and |

107.8 |

123.6 |

15.8 |

1.10 |

|

and |

146.2 |

176.5 |

30.3 |

0.37 |

|

and |

199.4 |

199.8 |

0.4 |

9.10 |

|

|

|

|

|

|

|

AX-24-545 |

35.0 |

41.2 |

6.2 |

0.41 |

|

and |

74.9 |

153.5 |

78.6 |

0.41 |

|

|

|

|

|

|

|

AX-24-546 |

36.8 |

65.4 |

28.6 |

0.38 |

|

|

|

|

|

|

|

AX-24-547 |

38.7 |

83.5 |

44.8 |

0.25 |

|

|

|

|

|

|

|

AX-24-548 |

26.5 |

106.1 |

79.6 |

0.56 |

|

and |

160.8 |

170.9 |

10.1 |

0.60 |

|

and |

185.5 |

219.2 |

33.7 |

0.55 |

|

|

|

|

|

|

|

AX-24-549 |

44.5 |

82.0 |

37.5 |

0.81 |

*True widths are estimated to be approximately 90% of drilled intervals.

Table 2: Drill Collar Location for Released Results

|

Collar ID |

East NAD83_Z8 |

North NAD83_Z8 |

Elev. (m) |

Azimuth |

Dip (°) |

Depth (m) |

|

AX-24-531 |

467651 |

7082953 |

803 |

357 |

-57 |

181.4 |

|

AX-24-532 |

467751 |

7082952 |

809 |

357 |

-58 |

193.6 |

|

AX-24-533 |

467752 |

7083047 |

803 |

001 |

-59 |

168.3 |

|

AX-24-534 |

466750 |

7083048 |

772 |

003 |

-59 |

199.6 |

|

AX-24-535 |

467651 |

7083039 |

800 |

357 |

-57 |

135.6 |

|

AX-24-536 |

467649 |

7083151 |

798 |

357 |

-58 |

100.6 |

|

AX-24-537 |

466657 |

7083050 |

766 |

356 |

-58 |

231.7 |

|

AX-24-538 |

467752 |

7083152 |

801 |

002 |

-58 |

96.1 |

|

AX-24-539 |

467862 |

7083050 |

812 |

360 |

-57 |

152.4 |

|

AX-24-540 |

466654 |

7083153 |

770 |

355 |

-60 |

231.7 |

|

AX-24-541 |

467947 |

7083054 |

816 |

003 |

-56 |

121.6 |

|

AX-24-542 |

466746 |

7083152 |

776 |

003 |

-60 |

201.2 |

|

AX-24-543 |

465552 |

7084255 |

685 |

004 |

-58 |

214.9 |

|

AX-24-544 |

466554 |

7083056 |

759 |

359 |

-63 |

225.6 |

|

AX-24-545 |

466453 |

7083153 |

745 |

003 |

-63 |

172.9 |

|

AX-24-546 |

468057 |

7083055 |

822 |

359 |

-59 |

126.5 |

|

AX-24-547 |

468156 |

7083056 |

828 |

360 |

-54 |

89.9 |

|

AX-24-548 |

466556 |

7083152 |

759 |

353 |

-61 |

230.1 |

|

AX-24-549 |

468253 |

7083053 |

833 |

002 |

-55 |

99.1 |

Upcoming Events

-

Precious Metals Forum Zurich - November 11 to 12

-

Corporate Presentation - November 11, 10:45 AM CET

-

Yukon Geoscience Forum - November 17 to 20

-

Corporate Presentation - November 17, 1:00 PM PST

-

New Orleans Investment Conference - November 20 to 23

-

Corporate Update and Breakfast - November 21, 7:15 AM CST

-

2024 Exploration Update

Banyan initiated its 2024 exploration program on June 1, 2024, and over the course of this season one hundred and eighteen (118) drillholes and over 21,000 m of drilling has been completed within the Powerline and Airstrip deposits. Drilling was completed in mid-October and core continues to be logged and processed with this expected to be completed by mid-November.

Analytical Method and Quality Assurance/Quality Control Measures

All drill core splits reported in this news release were analysed by Bureau Veritas of Vancouver, B.C., utilizing the aqua regia digestion ICP-MS 36-element AQ-200 analytical package with FA-450 50-gram Fire Assay with AAS finish for gold on all samples. All core samples were split on-site at Banyan's core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to the Bureau Veritas, Whitehorse preparatory laboratory where samples are prepared and then shipped to Bureau Veritas's Analytical laboratory in Vancouver, B.C., for pulverization and final chemical analysis. A robust system of standards, ½ core duplicates and blanks was implemented in the 2024 exploration drilling program and was monitored as chemical assay data became available.

Qualified Persons

Paul D. Gray, P.Geo., is a "qualified person" as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"), and has reviewed and approved the content of this news release. Mr. Gray is a consultant to Banyan and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the information.

About Banyan

Banyan's primary asset, the AurMac Project is located in Canada's Yukon Territory. The current inferred Mineral Resource Estimate ("MRE") for the AurMac Project of 7.0 million ounces has an effective date of February 6, 2024.

The 173 square kilometres ("sq km") AurMac Project lies 40 km from Mayo, Yukon. The AurMac Project is transected by the main Yukon highway and benefits from a 3-phase powerline, existing power station and cell phone coverage. Banyan has the right to earn up to a 100% interest, in both the Aurex and McQuesten Properties respectively, subject to certain royalties.

The inferred Mineral Resource Estimate "MRE" for the AurMac Project was prepared on February 6, 2024, and consisted of 7,003,000 ounces of gold (see Table 1) hosted within near surface, road accessible pit constrained Mineral Resources contained in two near/on-surface deposits: the Airstrip and Powerline Deposits.

Table 3: Pit-Constrained Inferred Mineral Resources - AurMac Property

SOURCE: Banyan Gold Corp.

View the original press release on accesswire.com