VANCOUVER, British Columbia, Jan. 14, 2025 (GLOBE NEWSWIRE) -- Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the “Company& or “Brixton&) is pleased to announce its regional prospecting-soil sampling program results and remaining drill results from its 2024 season at the wholly owned Thorn Project located in NW British Columbia, Canada. The Thorn Project is an underexplored copper-gold porphyry district with many large-scale exploration target areas identified.

Highlights

- Discovery of two new porphyry targets on trend along the Camp Creek corridor. The larger of the two zones is called Catalyst which is located 6-8 km from the Camp Creek Porphyry. Rock grab and chip samples of porphyry style stockwork veins from Catalyst returned up to 0.56% copper, 2.87 g/t gold, and 30.0 g/t silver. See Figures 1 to 5.

- Discovery of a porphyry style stockwork vein zones within a 3 km by 1.5 km altered area at the Sentinel Target. Rock sampling from the main Sentinel area generated results of up to 1.54% copper, 0.54% molybdenum, 0.2 g/t gold and 21.7 g/t silver. See Figures 1, 6, and 7.

- Regional rock samples assaying up to 46.9 g/t gold and 35.3% copper (at Calibre), 1525 g/t silver (at Misty).

Chairman and Chief Executive Officer, Gary R. Thompson, P.Geo., stated, “Our boots on the ground exploration approach has generated three new and exciting copper-gold porphyry targets that have never been drill tested. Brixton plans to drill some of these new targets in 2025 as well as follow up drilling on the Trapper Gold Target and Camp Creek Copper-Gold Target.&

Figure 1. Thorn Project Location Map with Copper Geochemistry.

Technical Discussion

The 2024 exploration season at the Thorn Project included an extensive surficial sampling and geological mapping program with a total of 1143 rocks, 316 soils and 28 stream sediment samples collected. In addition to sampling, a TerraSpec mineral spectrometer was utilized scanning approximately 2000 rock chips collected over the last two field seasons from across the project. The resulting short-wave infrared (SWIR) spectra data is used to assist in vectoring towards concealed porphyry deposits. Regional field work was focused on supporting 2024 drilling and advancing early-stage exploration targets to generate drill targets for the 2025 field season. Sampling was conducted across multiple target zones with highlights discussed below.

Figure 2. Camp Creek Corridor Map Highlighting Alignment of Porphyry-Epithermal Targets.

Copper Equivalent (CuEq) is calculated based on US$ 4.02/lb Cu, US$ 2105.6/oz Au, US$ 25.16/oz Ag, $US 20.99/lb Mo. These prices represent the approximate metal prices and calculations assume 95% metal recoveries.

CuEq % = (Cu % + (0.764486* Au g/t) + (0.009134 * Ag g/t) + (0.000523 * Mo ppm)) * 0.95

Catalyst-Tempest

At the end of the 2024 field season, two new Cu-Au-Mo porphyry targets were discovered adjacent to the northeast striking Camp Creek fault that hosts the Camp Creek and Cirque porphyry targets. With porphyry deposits often occurring in clusters or alignments, the new showings highlight the prospectivity of this major structure. Both of the new targets are hosted in Late Cretaceous porphyritic biotite-feldspar diorite intrusions with a U-Pb zircon geochronology sample returning an age date of 86.6 +/- 0.6 Ma. Overlying the porphyry are Windy Table volcanics with age dates of ~85-82 Ma. Field relationships between geological units suggest that mineralization at the new targets occurred prior to the deposition of Windy Table volcanics and are therefore of similar timing to the Camp Creek Porphyry.

The Catalyst showing, located 6 km northeast of the Camp Creek Porphyry Target, is defined by a 300 m long exposure consisting of stockwork quartz-chalcopyrite-molybdenite A veins hosted within a strong quartz-sericite-pyrite alteration zone. The showing is located within a broader 1.6 km by 1 km northeast trending alteration zone hosting phyllic to argillic assemblages, which transitions into a broader area of propylitic alteration. Soil sample assays suggest that Cu-Au-Ag-Mo mineralization extends up slope from the sampled vein zone.

Rock samples from the Catalyst showing returned up to 0.56% Cu, 0.11% Mo, 2.87 g/t Au, and 30.0 g/t Ag, including a 1.55 m chip across a stockwork vein zone which assayed 0.46% Cu, 68 ppm Mo, and 0.37 g/t Au (see Table 3). The anomalous gold values from samples containing porphyry style veins are encouraging for the potential of a gold-rich porphyry system. A total of 93 soil samples were collected with results up to 0.16% Cu, 0.24 g/t Au, 89 ppm Mo.

Figure 3. Rock Sample Photos from the Catalyst Showing.

The Tempest showing is located 4.5 km east of the Camp Creek Porphyry and 2.5 km south of the Catalyst showing, hosting a 500 m by 600 m zone of moderate to strong sericite-clay-pyrite altered porphyry with high sericite crystallinity identified from the SWIR data. At the northwest end of the target, an area with limited outcrop exposure contains stockwork quartz-chalcopyrite-pyrite- molybdenite A veins and pyrite-sericite D veins. The presence of copper sulphides, porphyry style veins, and widespread sericite alteration indicates close proximity to a mineralizing intrusion. The extents of alteration and mineralization are currently open to the west, north and east under cover of glacial till and post-mineral volcanic deposits. A magnetic high to the north of the showing suggests potential continuity of the hydrothermal system to the north. Rock sampling at Tempest returned up to 0.36% Cu, 0.28 g/t Au, 10.8 g/t Ag, and 104 ppm Mo.

Figure 4. Rock Sample Photos from the Tempest Showing.

Figure 5. 2024 Samples from the Catalyst and Tempest Showings with Copper-Gold Geochemistry.

Sentinel Target

Sentinel is a newly recognized Cu-Mo porphyry target located within the East Target. The East Target hosts several mineralized Late Cretaceous intrusions, including at the Bing and Icy Cu-Mo porphyry targets. Sentinel is underlain by Late Triassic intrusive rocks and intermediate to felsic volcanics of interpreted upper Cretaceous age. The target was first identified by a large clay anomaly from Sentinel-2 remote sensing satellite data and follow-up talus fines sampling over the area generated a large Mo-Cu anomaly.

In 2024 sampling and geological mapping was focused within the anomalous area leading to discovery of multiple zones of stockwork porphyry style quartz veining accompanied by potassic, phyllic, and argillic alteration assemblages that zone out to propylitic alteration, all within a 3 km by 1.5 km area. Vein density was systematically mapped, highlighting zones of greater than 10% quartz veining and locally up to 30%. Sulphide abundance is low in the main vein zones, coinciding with low copper values, and is interpreted to be the result of a leached cap. It is believed that sulphide abundance should increase with depth below the leached cap. Rock sampling from the main Sentinel area generated results of up to 1.54% Cu, 0.54% Mo, 0.2 g/t Au and 21.7 g/t Ag (see Table 4).

Extensive copper oxides were sampled 3.5 km to the southeast of the stockwork vein zone, hosted in a potassium feldspar altered monzonite with samples assaying up to 1.12% Cu. This area has seen limited work and will be further investigated in 2025.

Figure 6. Rock Sample Photos from the Sentinel Target.

Figure 7. 2024 Samples from the Sentinel Target with Copper and Molybdenite Geochemistry.

Calibre

The Calibre Target encompasses the region southwest of Brixton&s Camp Creek Cu-Au-Ag-Mo porphyry and Trapper Gold Targets and hosts significant copper-silver-gold mineralization. Numerous new showings were discovered in areas with no historic samples. Late Triassic to Eocene intrusive and volcanic rocks host polymetallic veins with assays up to 46.9 g/t Au, 1040 g/t Ag, 35.3% Cu (see Table 5). Of the 121 grab samples collected, 16 returned greater than 1% Cu. Of particular interest are mineralized and altered intermediate to felsic volcanics of probable Late Cretaceous age, not previously recognized in the area. This stratigraphically significant unit is associated with multiple epithermal and porphyry mineral occurrences within the Thorn Project, including the Camp Creek, Cirque, Catalyst-Tempest, and Sentinel Targets, and provides a favourable setting for magmatic-hydrothermal alteration. The new showings will be further evaluated for porphyry and epithermal potential in 2025.

Figure 8. Rock Sample Photos from the Calibre Target.

Figure 9. 2024 Samples from the Calibre Target with Copper and Gold Geochemistry.

Misty Target

Rock sampling was completed at the Misty Target located within a newly acquired claim block that borders the historic Golden Bear Mine, which produced greater than 485,000 ounces of gold. Samples were collected within areas of glacial recession in an area of limited historic work, approximately 2.5 km north-northwest of the Bear Main open pit.

A total of 23 rock samples were collected returning up to 31.6% Cu, 1525 g/t Ag, and 1.42 g/t Au with five samples assaying greater than 1% Cu (see Table 6). Quartz veins with semi-massive pyrite-chalcopyrite are found within Stikine Assemblage Paleozoic volcanic rocks.

Figure 10. Rock Sample Photos from the Misty Target.

Figure 11. 2024 Samples from the Misty Target with Copper and Gold Geochemistry.

Trapper

New areas of copper mineralization were uncovered during the 2024 field season in the Trapper area, approximately 5 km east of the main area of drilling at the epithermal gold target. Prospecting was completed proximal to an illite-dickite-kaolinite alteration zone previously identified by Barrick Gold in 2005. Widespread copper oxides accompanied by pyrite and rare chalcopyrite were sampled in both upper Triassic and upper Cretaceous volcanic rocks. Of the 22 samples from this area, three returned greater than 1% Cu with values of up to 3.76% Cu (see Table 7). The clay minerals identified from SWIR results, accompanied by areas of sodium and calcium depletion suggest the potential presence of a lithocap environment that forms at the upper levels of porphyry systems. Mapping in 2025 will assess the prospectivity of this area. To the south of main drilling, a previously unsampled area of quartz-carbonate-sulphide veins in upper Triassic volcanic rocks returned values of up to 11.9% Cu.

A soil grid was completed approximately 700 m southeast of the main area of drilling in an area with no outcrop to assist in undercover targeting of gold mineralization along trend of the main Trapper system. Of the 51 samples collected, seven samples assayed greater than 100 ppb Au with values up to 1680 ppb Au.

Figure 12. 2024 Samples from the Trapper Target with Copper and Gold Geochemistry.

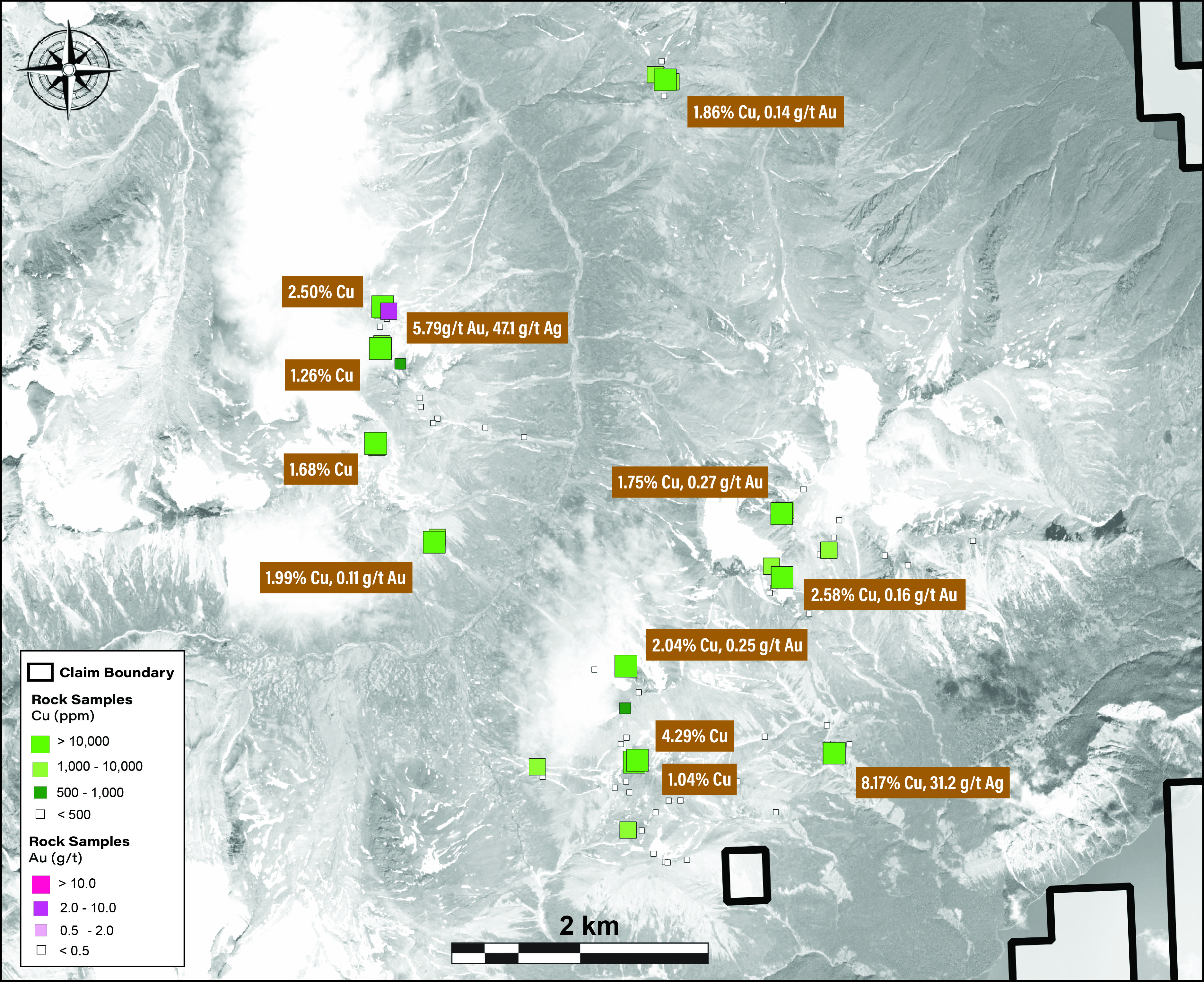

Plum

The Plum Target is an early-stage, porphyry-epithermal target located 30 km southeast of Thorn Camp bordering Brixton&s Metla Target to the west as well as the historic Golden Bear Mine claims to the south. Plum is characterized by a large iron-oxide clay alteration footprint that extends over 10 km2 and is largely comprised of Stikine Assemblage volcaniclastic rocks and Triassic age intrusive units. The area has seen both historical and recent exploration work including mapping, prospecting, and soil sampling. Field work was carried out in areas with little to no historic sampling to better define the target potential for both porphyry-copper and epithermal-gold mineralization.

A total of 92 rock samples were collected with 11 samples returning greater than 1% Cu and one sample returning 5.79 g/t Au with copper dominant mineralization found in quartz-carbonate veins (see Table 8).

Figure 13. 2024 Samples from the Plum Target with Copper and Gold Geochemistry.

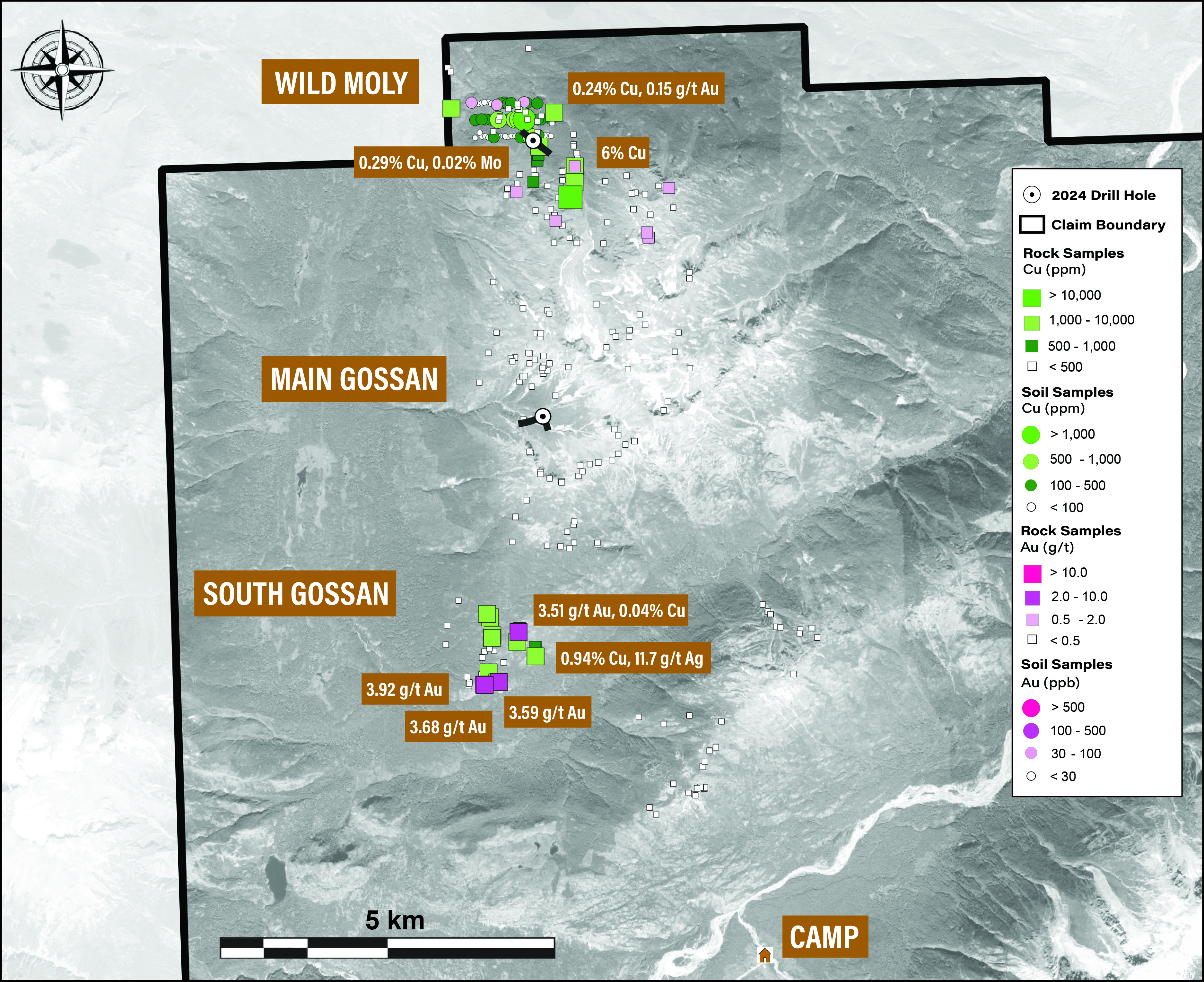

North Target

The North Target is located approximately 10 km north of Thorn Camp and was actively explored for its porphyry Cu-Au-Ag-Mo potential during the 2024 field season. The North Target hosts upper Triassic volcanic rocks, lower Jurassic sedimentary rocks and Late Cretaceous to Eocene porphyritic intrusions. Geological mapping, rock and soil sampling was completed to support the 2024 drill program with four holes drilled at the North Target for a total of 2,266m.

A total of 257 rock and 71 soil samples were collected. Mapping and sampling were successful in outlining the extents of numerous alteration zones across the target area. Rock samples returned up to 3.92 g/t Au, 542 g/t Ag, and 6.0% Cu (see Table 9), and soils up to 0.12% Cu and 160 ppm Mo. Rock and soil geochemistry, geophysics, SWIR results, and mapping data will be utilized for further targeting within the 11 km by 4 km trend of porphyry to epithermal alteration that spans across the target area.

Figure 14. 2024 Samples from the North Target with Copper and Gold Geochemistry.

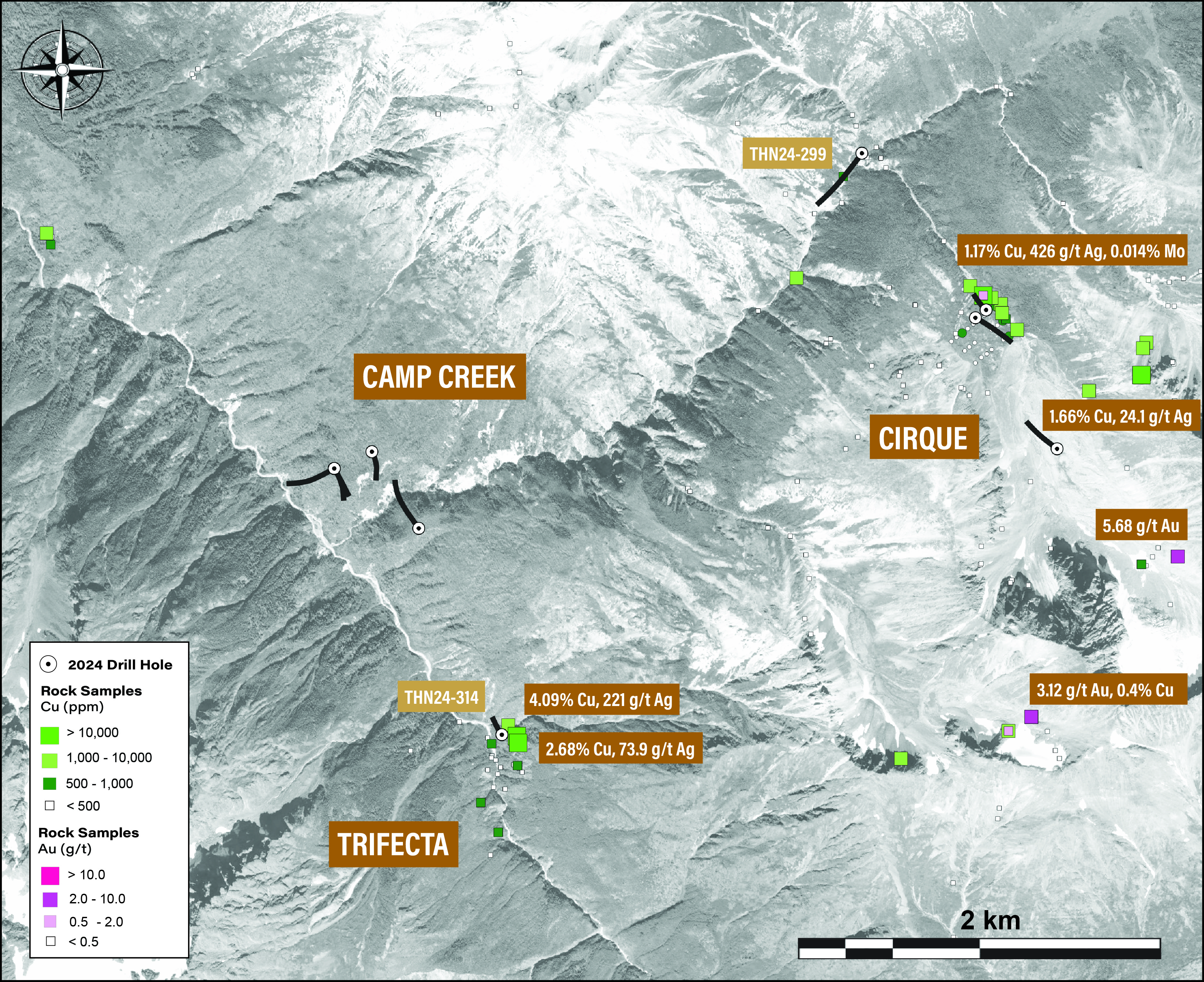

Trifecta-Cirque

Further exploration efforts were conducted proximal to Camp Creek with geological mapping and rock sampling completed at the Trifecta and Cirque porphyry targets to support the 2024 drill campaign. A total of 167 rock samples were collected, with samples at Cirque returning up to 1.66% Cu and 3.12 g/t Au (see Table 10). At Trifecta, quartz-carbonate-barite veins occur in a 1-3 m thick vein breccia within upper Triassic volcanic rocks and returned values of 4.09% Cu and 221 g/t Ag. The veins sit within a larger 400m x 400m Cu-in-soil anomaly that was drill tested during the 2024 field season.

Figure 15. 2024 Samples from the Trifecta and Cirque Targets with Copper and Gold Geochemistry.

Prospecting and mapping was followed up with drilling at both targets. Initial drill results from the Cirque Target were released on September 17, 2024. The remaining hole, THN24-299 was drilled at an azimuth of 214.9 degrees and a dip of –55.0 degrees to a final depth of 686.00m. Hole 299 was planned to target sheeted porphyry-style veins containing chalcopyrite and molybdenite mineralization identified at surface, approximately 3 km northeast of the Camp Creek porphyry. The porphyry-style veins are hosted in Cretaceous age felsic to intermediate volcanics of the Windy Table Group with moderate to strong quartz-sericite-pyrite alteration.

While THN24-299 intersected narrow intervals of porphyry-style veining and mineralization resulting in only modest grades, drilling confirmed the presence of a mineralizing porphyry system nearby to which hole 299 is interpreted to have drilled along the margins of the phyllic alteration halo. Select assay intervals are listed in Table 1 below.

At Trifecta, THN24-314 was drilled at an azimuth of 325 degrees and a dip of –75 degrees to a final depth of 466.0m and did not return any significant assays. Trace occurences of chalcopyrite and molybedenite mineralization were observed within sparse quartz veins hosted in a dominantly chlorite altered lapilli tuff of the Triassic Stuhini Group.

Table 1. Select Assay Intervals for THN24-299.

| Hole ID | From

(m) |

To (m) | Interval

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

Mo (ppm) | CuEq

(%) |

| THN24-299 | 259.50 | 287.50 | 28.00 | 0.07 | 0.04 | 2.01 | 19.6 | 0.12 |

| including | 259.50 | 270.00 | 10.50 | 0.10 | 0.05 | 3.01 | 22.7 | 0.17 |

| and | 441.00 | 495.00 | 54.00 | 0.08 | 0.01 | 1.19 | 19.6 | 0.11 |

Copper Equivalent (CuEq) is calculated based on US$ 4.02/lb Cu, US$ 2105.6/oz Au, US$ 25.16/oz Ag, $US 20.99/lb Mo. These prices represent the approximate metal prices and calculations assume 95% metal recoveries.

CuEq % = (Cu % + (0.764486* Au g/t) + (0.009134 * Ag g/t) + (0.000523 * Mo ppm)) * 0.95

Conclusions

Results from the 2024 field season highlight the district-scale potential for new discoveries within the Thorn Project. With porphyry deposits often occurring in clusters or alignments, the geological team is encouraged by the new discoveries at the Catalyst-Tempest and Sentinel Targets. Targeting over the winter will utilize geochemistry, geophysics, geological mapping, and SWIR results to generate drill targets and follow-up work for the 2025 field season. Numerous broad areas of the Thorn Project remain underexplored and Brixton Metals will continue to apply a mineral systems approach to advance established targets and search for unrecognized hydrothermal systems.

Table 2. Collar Information for Drill Holes from Current Release.

| Hole ID | Easting | Northing | Elevation (m) | Azimuth | Dip | Depth (m) |

| THN24-299 | 630622 | 6493904 | 1089 | 214.9 | -55 | 686 |

| THN24-314 | 628603 | 6490641 | 667 | 325 | -75 | 466 |

Table 3. 2024 Catalyst-Tempest Target Surface Sampling Highlights.

| Sample | Cu (%) | Mo (ppm) | Au (g/t) | Ag (g/t) |

| D201898 | 0.56 | 2.44 | 0.04 | 14.9 |

| D201221 | 0.52 | 38.0 | 0.99 | 1.69 |

| D201227 | 0.51 | 36.1 | 1.11 | 3.12 |

| D201229 | 0.46 | 67.9 | 0.37 | 2.41 |

| D201896 | 0.40 | 31.3 | 1.23 | 2.39 |

| D201222 | 0.39 | 35.4 | 0.57 | 1.93 |

| D201077 | 0.36 | 16.8 | 0.15 | 10.8 |

| D201240 | 0.13 | 104 | 0.15 | 1.16 |

| D201228 | 0.12 | 33.8 | 0.27 | 0.69 |

| D201220 | 0.12 | 35.0 | 0.21 | 0.47 |

| D201236 | 0.06 | 2.99 | 2.87 | 30.0 |

| D201237 | 0.03 | 2.04 | 1.16 | 8.27 |

Table 4. 2024 Sentinel Target Surface Sampling Highlights.

| Sample | Cu (%) | Mo (ppm) | Au (g/t) | Ag (g/t) |

| D200847 | 19.4 | 13.1 | 0.04 | 15.5 |

| D132114 | 1.54 | 11.5 | 0.20 | 21.7 |

| D132110 | 1.15 | 13.1 | 0.03 | 55.8 |

| D132109 | 0.65 | 1.16 | 0.04 | 28.9 |

| D132111 | 0.62 | 3.95 | 0.01 | 10.0 |

| D201971 | 0.62 | 2.30 | 0.03 | 43.8 |

| D201972 | 0.57 | 3.38 | 0.02 | 20.0 |

| D132108 | 0.56 | 4.07 | 0.01 | 6.72 |

| D132275 | 0.51 | 662 | 0.01 | 12.8 |

| D201970 | 0.33 | 1.38 | 0.01 | 29.8 |

| D131815 | 0.31 | 4420 | 0.10 | 0.85 |

| D132286 | 0.31 | 2.64 | 0.04 | 3.69 |

| D201964 | 0.28 | 7.93 | 0.01 | 1.50 |

| D132277 | 0.25 | 4.91 | 0.07 | 5.61 |

| D132289 | 0.25 | 4.56 | 0.03 | 3.88 |

| D131340 | 0.23 | 4.24 | 0.01 | 0.53 |

| D132320 | 0.13 | 58.8 | 0.03 | 3.40 |

| D132319 | 0.11 | 34.9 | 0.01 | 0.76 |

| D132315 | 0.10 | 36.7 | 0.01 | 0.23 |

| D131814 | 0.09 | 139 | 0.01 | 0.71 |

| D132273 | 0.01 | 5390 | 0.01 | 0.64 |

| D131300 | 0.00 | 471 | 0.01 | 0.07 |

Table 5. 2024 Calibre Surface Sampling Highlights.

| Sample | Cu (%) | Au (g/t) | Ag (g/t) |

| D132245 | 35.3 | 2.97 | 771 |

| D132149 | 16.4 | 0.18 | 67.2 |

| D131973 | 12.1 | 0.06 | 160 |

| D132246 | 11.4 | 46.9 | 237 |

| D132360 | 5.78 | 0.02 | 9.00 |

| D132363 | 5.51 | 0.15 | 187 |

| D201103 | 3.86 | 0.11 | 14.9 |

| D132248 | 2.86 | 2.12 | 322 |

| D201105 | 2.79 | 0.02 | 64.0 |

| D131783 | 1.77 | 0.54 | 19.2 |

| D131968 | 1.74 | 0.10 | 1040 |

| D201104 | 1.63 | 0.41 | 54.1 |

| D131648 | 1.37 | 0.11 | 74.2 |

| D132243 | 1.24 | 0.15 | 42.9 |

| D131650 | 1.17 | 0.03 | 82.1 |

| D132135 | 1.08 | 0.02 | 45.5 |

| D131972 | 0.95 | 0.18 | 273 |

| D132146 | 0.57 | 0.10 | 0.66 |

| D132132 | 0.55 | 0.03 | 26.4 |

| D132362 | 0.45 | 0.37 | 160 |

| D132144 | 0.42 | 1.91 | 1.14 |

| D131966 | 0.39 | 0.04 | 282 |

| D131965 | 0.38 | 0.04 | 372 |

| D131967 | 0.31 | 0.07 | 541 |

| D201940 | 0.19 | 0.03 | 4.12 |

| D131974 | 0.12 | 1.31 | 5.16 |

| D131975 | 0.11 | 0.04 | 116 |

| D131645 | 0.00 | 1.27 | 6.36 |

Table 6. 2024 Misty Target Surface Sampling Highlights.

| Sample | Cu (%) | Au (g/t) | Ag (g/t) |

| D201950 | 31.6 | 0.42 | 85.6 |

| D132374 | 28.1 | 0.71 | 1525 |

| D132373 | 26.2 | 0.55 | 95.7 |

| D201949 | 19.8 | 0.28 | 106 |

| D132375 | 16.0 | 1.42 | 114 |

Table 7. 2024 Trapper Target Surface Sampling Highlights.

| Sample | Cu (%) | Au (g/t) | Ag (g/t) |

| D201886 | 11.9 | 0.53 | 211 |

| D132102 | 3.76 | 0.02 | 3.63 |

| D132103 | 1.80 | 0.01 | 3.30 |

| D132101 | 1.48 | 0.01 | 0.46 |

| D132741 | 0.86 | 0.01 | 2.54 |

| D132740 | 0.77 | 0.01 | 3.23 |

| D132219 | 0.75 | 0.01 | 3.13 |

| D201884 | 0.52 | 0.02 | 0.92 |

Table 8. 2024 Plum Target Surface Sampling Highlights.

| Sample | Cu (%) | Au (g/t) | Ag (g/t) |

| D201917 | 8.17 | 0.06 | 31.2 |

| D132234 | 4.29 | 0.01 | 3.70 |

| D131545 | 2.58 | 0.16 | 8.44 |

| D201066 | 2.50 | 0.06 | 1.84 |

| D132486 | 2.04 | 0.25 | 2.81 |

| D201951 | 1.99 | 0.11 | 3.00 |

| D131531 | 1.86 | 0.14 | 6.53 |

| D201957 | 1.75 | 0.27 | 2.02 |

| D131550 | 1.68 | 0.04 | 5.02 |

| D132139 | 1.26 | 0.01 | 0.39 |

| D132233 | 1.04 | 0.01 | 2.40 |

| D132138 | 0.82 | 0.05 | 0.64 |

| D201691 | 0.79 | 0.10 | 2.69 |

| D132475 | 0.75 | 0.01 | 2.24 |

| D131542 | 0.67 | 0.07 | 0.99 |

| D201068 | 0.02 | 5.79 | 47.1 |

Table 9. 2024 North Target Surface Sampling Highlights.

| Sample | Cu (%) | Mo (ppm) | Au (g/t) | Ag (g/t) |

| D201927 | 6.00 | 2.61 | 0.07 | 160 |

| D201062 | 0.94 | 10.4 | 0.07 | 11.7 |

| D132118 | 0.40 | 1.47 | 0.04 | 3.53 |

| D201991 | 0.29 | 198 | 0.01 | 0.21 |

| D201064 | 0.27 | 16.7 | 0.01 | 1.39 |

| D131295 | 0.24 | 4.96 | 0.15 | 9.18 |

| D132301 | 0.05 | 17.5 | 1.95 | 11.0 |

| D201060 | 0.04 | 1.48 | 3.51 | 37.0 |

| D201057 | 0.04 | 7.79 | 1.13 | 542 |

| D131828 | 0.02 | 0.97 | 3.92 | 0.74 |

| D131834 | 0.02 | 0.84 | 3.59 | 0.93 |

| D131835 | 0.02 | 1.22 | 3.68 | 0.78 |

| D131833 | 0.01 | 1.82 | 2.89 | 0.62 |

| D201956 | 0.01 | 0.89 | 1.00 | 7.58 |

| D131951 | 0.01 | 0.72 | 1.21 | 2.00 |

Table 10. 2024 Trifecta-Cirque Target Surface Sampling Highlights.

| Sample | Cu (%) | Mo (ppm) | Au (g/t) | Ag (g/t) |

| D132004 | 4.09 | 1.12 | 0.15 | 221 |

| D132002 | 2.68 | 3.74 | 0.01 | 73.9 |

| D132309 | 1.66 | 45.0 | 0.10 | 24.1 |

| D132723 | 1.17 | 136 | 0.67 | 426 |

| D131548 | 0.40 | 13.4 | 3.12 | 10.2 |

| D201813 | 0.30 | 2.80 | 0.05 | 16.2 |

| D132470 | 0.19 | 10.4 | 1.84 | 22.8 |

| D132731 | 0.08 | 32.1 | 5.68 | 58.2 |

Rocks collected are select grab samples of mineralized outcrops within each of the target areas and do not represent the entire target.

Rock samples were prepared by ALS Minerals preparation facility in Whitehorse, YT and assayed at ALS Laboratory Facilities in North Vancouver, British Columbia. ALS Minerals Laboratories is registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Samples were analyzed for gold by fire assay with an atomic absorption finish, whereas Ag, Pb, Cu and Zn and 48 additional elements were analyzed using four acid digestion with an ICP-MS finish.

Qualified Person

Mr. Daniel Guestrin, P.Geo., is a Senior Project Geologist for the Company who is a qualified person as defined by National Instrument 43-101. Mr. Guestrin has verified the referenced data and analytical results disclosed in this press release and has approved the technical information presented herein.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton&s flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel Project in Ontario and the Atlin Goldfields Project located in northwest BC which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB, and on the OTCQB under the ticker symbol BBBXF. For more information about Brixton, please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

For Investor Relations inquiries please contact: Mr. Michael Rapsch, Senior Manager, Investor Relations. email: michael.rapsch@brixtonmetals.com or call: 604-630-9707

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate&, “believe&, “plan&, “estimate&, “expect&, and “intend&, statements that an action or event “may&, “might&, “could&, “should&, or “will& be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management&s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Figures accompanying this announcement are available at:

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure1_14Jan2025-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-2_14Jan2025-Camp-Creek-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-3_14Jan2025-Catalyst.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-4_14Jan2025-Tempest.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-5_14Jan2025-Cirque-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-6_14Jan2025-Sentinel.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-7_14Jan2025-Sentinel-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-8_14Jan2025-West.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-9_14Jan2025-Calibre-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-10_14Jan2025-Misty.png

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-11_14Jan2025-Misty-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-12_14Jan2025-Trapper-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-13_14Jan2025-Plum-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-14_14Jan2025-NTarget-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/01/Figure-15_14Jan2025-TrifectaCirque-scaled.jpg