ROUYN-NORANDA, Quebec, Nov. 21, 2024 (GLOBE NEWSWIRE) -- GLOBEX MINING ENTERPRISES INC. (GMX – Toronto Stock Exchange, G1MN – Frankfurt, Stuttgart, Berlin, Munich, Tradegate, Lang & Schwarz, LS Exchange, TTMzero, Düsseldorf and Quotrix Düsseldorf Stock Exchangesand GLBXF – OTCQX International in the US) is pleased to inform shareholders that O3 Mining Inc. (OIII-TSXV, OIIIF-OTCQX) have initiated a two drill, 8,000 metre exploration program on the Cameron and Florence sections of their Kinebik Project which straddles over 55 kilometres strike of the auriferous Casa Berardi trend in Quebec, northwest of Lebel-sur-Quevillon. The Casa Berardi trend is the location of several large gold deposits including the +5-million-ounce Casa Berardi gold deposit.

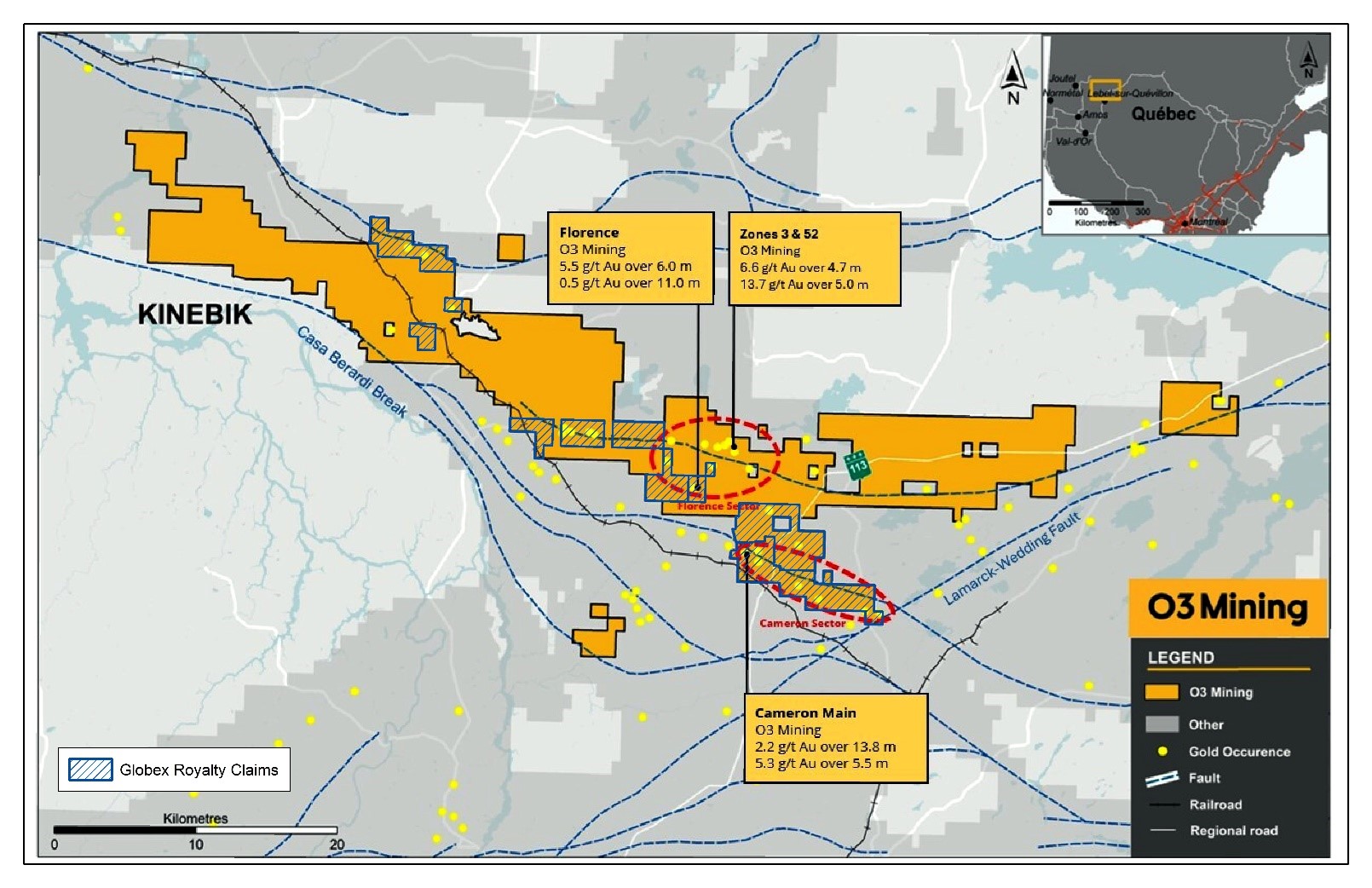

O3 Mining, in yesterday&s press release, has reported that the current drill program will focus principally on the Cameron and Florence areas which in large part were purchased from Globex (see Globex press release dated December 22, 2023). Globex sold 156 claims to O3 Mining for $2,000,000 payable, $150,000 in cash and 1,185,897 O3 Mining common shares. Globex retains a 2.5% Gross Metal Royalty on 104 claims and 1% Gross Metal Royalty on 52 claims. O3 Mining assumed responsibility for a pre-existing underlying 2% Net Smelter Royalty on the 52 claims purchased from Globex.

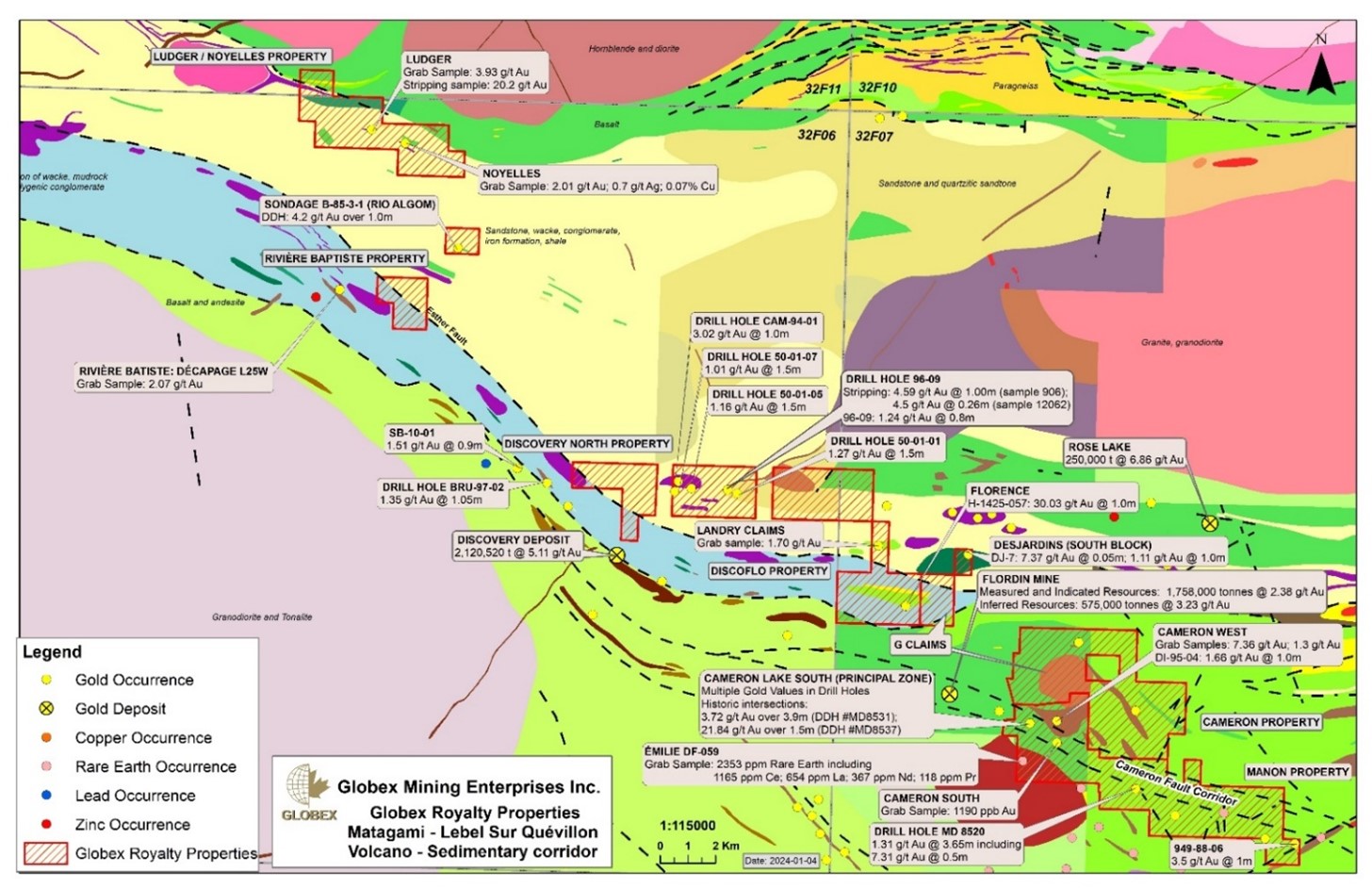

Globex Mining Enterprises Inc. Properties Outlined in Red Sold to O3 Mining

Current O3 Mining Map of Kinebik Project – Globex Royalty Claims Outlined in Blue and Priority Drill Areas in Red

The eight claim blocks that Globex sold to O3 Mining include numerous gold intersections in drill holes as well as surface showings. Previous geophysics, geologic mapping and prospecting and follow-up drilling demonstrated the yet to be adequately defined potential of the areas. Globex has full confidence in O3 Mining&s team of first-class explorationists to carry the projects forward.

The Cameron area, designated for initial exploration in this drill program, straddles the east extension of the gold bearing horizon of the Flordin Gold Mine (per Abcourt Mines, May 2023 NI 43-101 Report by Oliver Vadnais-Leblanc P.Geo., Carl Pelletier P.Geo., Eric Lecomte P.Eng., and Simon Boudreau P.Eng. from InnovExplo Inc., 1,530,000 tonnes grading 2.18 g/t Au measured and indicated and 244,000 tonnes grading 2.38 g/t Au Inferred) and the Cartright Gold Zone (recent channel sampling up to 10.4 g/t Au over 12m) close to the Cameron claim blocks west boundary. The Florence claim block straddles a parallel series of gold bearing geological rock units. And, is east-northeast of the Discovery Gold Zone (Measured and Indicated Resource 1,186,000 tonnes grading 4.66 g/t Au and Inferred Resource 1,970,000 tonnes grading 4.80 g/t Au, March 28, 2023, NI 43-101, by Olivier Vadnais-Leblanc, P.Geo., Simon Boudreau, P.Eng., and Eric Lecomte, P.Eng. of InnovExplo Inc. per Abcourt Mines).

This press release was written by Jack Stoch, P. Geo., President and CEO of Globex in his capacity as a Qualified Person (Q.P.) under NI 43-101.

| We Seek Safe Harbour. | Foreign Private Issuer 12g3 – 2(b) |

| CUSIP Number 379900 50 9

LEI 529900XYUKGG3LF9PY95 |

|

| For further information, contact: | |

| Jack Stoch, P.Geo., Acc.Dir.

President & CEO Globex Mining Enterprises Inc. 86, 14th Street Rouyn-Noranda, Quebec Canada J9X 2J1 |

Tel.: 819.797.5242 Fax: 819.797.1470 info@globexmining.com www.globexmining.com |

Forward Looking Statements: Except for historical information, this news release may contain certain “forward looking statements&. These statements may involve a number of known and unknown risks and uncertainties and other factors that may cause the actual results, level of activity and performance to be materially different from the expectations and projections of Globex Mining Enterprises Inc. (“Globex&). No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Globex will derive therefrom. A more detailed discussion of the risks is available in the “Annual Information Form& filed by Globex on SEDARplus.ca.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/be044425-1020-41e9-ab67-14b9be4be133

https://www.globenewswire.com/NewsRoom/AttachmentNg/b2638bf7-c34f-41d7-b40e-8d9e74c99b8f