VANCOUVER, BC / ACCESSWIRE / August 15, 2024 / Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIR)(OTCQB:PMMCF) is pleased to provide a Project Update for the Piuquenes Cu-Au porphyry project, San Juan, Argentina.

Current Activities

Since completing a maiden drill program at Piuquenes, the Company has prioritized the integration of recent drilling data with historical information which includes:

-

Surface Geology and Geochemistry (1:2500);

-

Geophysics - gDAS24 3D Pole-Dipole IP/Resistivity & Natural Source Magneto-Tellurics (17.8line-km);

-

Airborne magnetic/radiometric survey; and

-

2,800m of well-preserved historical drill core (refer 17 June 2024 News Release).

Aided by 4-acid multi-element geochemical data and reprocessed and interpreted historical geophysical data, the Company is also finalizing 3D geological modelling and grade and lithology interpretation at the Piuquenes Central porphyry Cu-Au deposit

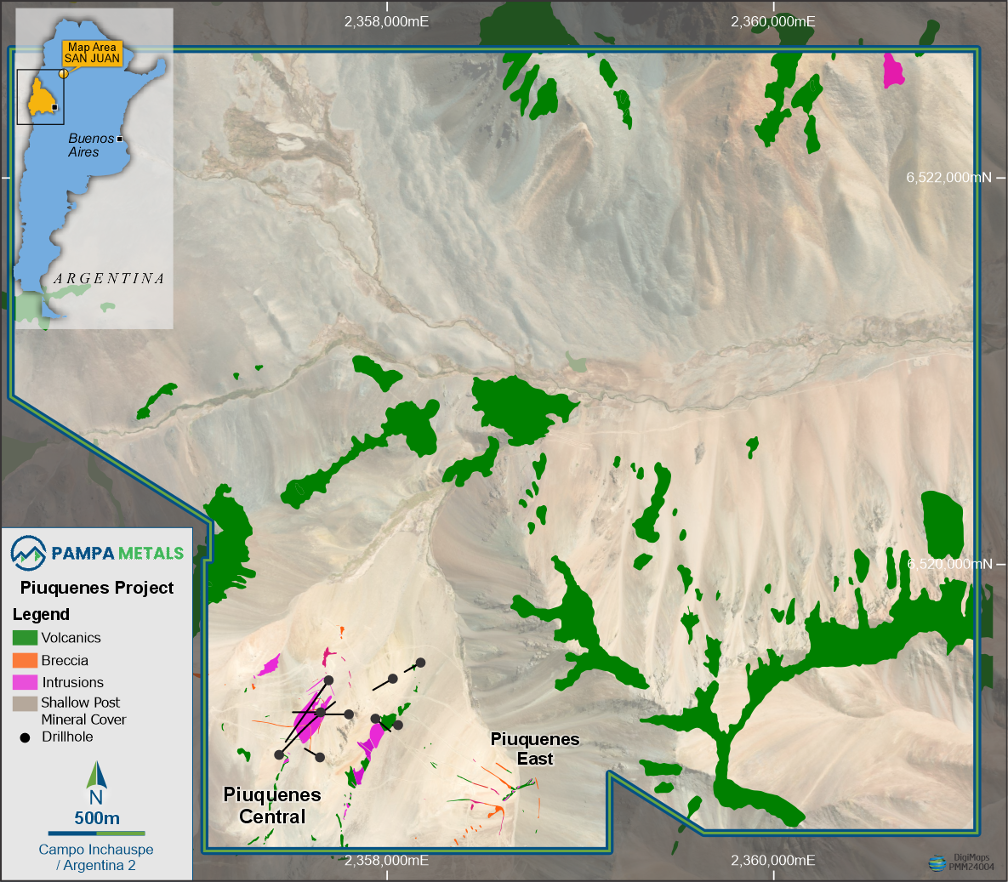

Concurrently, the Company continues to review the property wide upside potential, with Pampa Metals' mineral tenure extending for over 3km to the north of Piuquenes Central, with minimal exploration conducted over the area to date (refer Figure 1). The underlying geology is almost entirely masked at surface by thin transported cover, with no exploration drilling completed under this cover.

The solid progress of these work programs has allowed Initial targeting and planning for the 2024/25 field season to begin. Company management is currently in San Juan finalizing preparations for the next field season, which will include further drill evaluation at Piuquenes Central, the initial drill testing of Piuquenes East, field mapping to advance several other nearby targets, and further geophysics if required.

Next Steps

The Company will provide further updates on the key findings from the 3D model development and the geophysical data integration once finalized, as well as the timing and scope of the 2024/25 field season work programs, preparation for which has already begun.

Joseph van den Elsen, Pampa Metals President and CEO commented: "We are very pleased with the rapid progress we are making at Piuquenes and are excited by the upcoming field season. The Piuquenes project is a Company making asset and we look forward to more fully delineating the size and grade potential of the first deposit during the 2024/25 field season and concurrently testing a second undrilled, outcropping porphyry at Piuquenes East. Desktop work to-date confirms the potential for a cluster of deposits and we will advance several other targets this field season through surface exploration and possibly geophysics."

ON BEHALF OF THE BOARD & INVESTOR CONTACT:

Joseph van den Elsen | President & CEO | Joseph@pampametals.com

ABOUT PAMPA METALS

Pampa Metals is a copper-gold exploration company listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE:FIR), and OTC (OTCQB:PMMCF) exchanges.

In November 2023, the Company announced it had entered into an Option and Joint Venture Agreement for the acquisition of an 80% interest in the Piuquenes Copper-Gold Porphyry Project in San Juan Province, Argentina.

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENT

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

SOURCE: Pampa Metals Corp.

View the original press release on accesswire.com